Find the Cheapest Way to Transfer Money Overseas

How Do I Compare Money Transfer Services?

-

Step 1

GET ACQUAINTED

Tell us the currency you will be sending and the currency you need it converted into. -

Step 2

KNOW YOUR OPTIONS

We’ll compare the rates and fees from our trusted partners, and highlight your options in a personalised side-by-side comparison. -

Step 3

SNAFFLE THE DEAL

When you have made your decision, click the link to the money exchange providers site and make your purchase. We don’t add costs, or charge markups so you get the best deal possible.

We compare the world’s most trusted brands

The Best Online International Money Transfer Services in NZ

Want more information about the best international money transfer services, but don't know where to start?

Don't worry, after reviewing over 30 banks and money transfer companies, we compiled our list of the cheapest, easiest and safest online money transfer providers for you:

1. Sending Money Regularly: WorldRemit

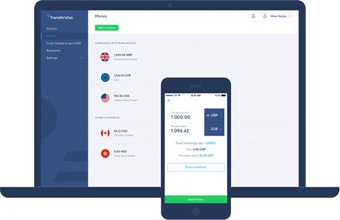

2. Small Transfer Amounts: Wise

3. Larger Amounts: XE

4. Business Money Transfers: OFX

Regular transfers to friends & family

WorldRemit specialises in smaller, regular transfers known as remittances. Because of this, they're tailored to personal and individual transfers to family and friends.

We particularly like them for transfers to Asia (China), Africa and South America for small transfer amounts up to NZ$10,000.

WorldRemit exchange rates are usually better than your local bank's. They also offer more flexible delivery options like cash transfers and mobile airtime, compared to companies like PayPal, Western Union or MoneyGram.

- Offers cash pick-up, bank deposits, Mobile Money and Airtime top-up

- Easy online platform and mobile phone app

- Transparent costs with accurate calculator tool

- WorldRemit has competitive exchange rates

- No minimum transfer amount

- 24/7 customer support available

- Maximum transfer size of NZ$50,000 for POLI; and NZ$6,000 for card payments

- Transfer fee is not fixed for different currencies

- Don't offer support for New Zealand businesses

- Unable to offer financial advice

- Not all transfer methods are available in all countries. For example cash pick-up in India

Cheapest for smaller amounts

Wise (formerly known as TransferWise) are great if you want a fast, hassle-free, low cost way to send smaller amounts money overseas. They are also perfect for expats, sending money back home or receiving money from overseas.

Wise offer a quick, easy to use online service and mobile app. They also offer you the best exchange rates — identical to the market rate (also know as the interbank rate) that you see on Google or XE.

They charge a small, percentage-based currency exchange service fee. A percentage-based fee is ideal for sending or receiving up to NZ$40,000.

- It’s very fast and easy to create an account

- They offer the best exchange rates available

- Their service charge is low, no hidden fees and pricing is easy to understand

- You can pay via bank transfer, credit or debit card

- There’s no minimum transfer size

- Can't pay for your transfer via cash or cheque

- There’s limited customer support

- If you’re transferring more than $10,000, their percentage fee can make them less competitive than other services

- They don’t support all global currencies

Trusted for larger transfers

The overall XE business has been around since 1993, so they know a thing or two about sending larger amounts of money over NZ$10,000, safely.

With competitive rates and no fees, there is a lot to like about XE. And if you haven't made a transfer before, you might especially like that they are an established and trusted currency brand.

XE also have customer support who can assist you if you don't want to do everything regarding your transfer online or even if you just have some questions.

- XE are a worldwide, trusted authority for currency exchange

- They don’t charge any fees for sending money overseas

- There’s no minimum transfer amount

- It’s easy to get in touch with and use their customer service

- Their website is quick and easy to use

- You can’t pay for your transfer using cash or a cheque

- There’s limited customer support over the weekend

- Exchange rates may not be as competitive as others in this space

- They don’t support all global currencies

Best fee-free for businesses

For over 18 years OFX has been supporting New Zealand businesses. With an entirely online platform, OFX has helped businesses transfer money between over 197 countries globally.

They are particularly good at reducing the cost of FX international payments for businesses. This is because for larger amounts, they have no transfer fee and the exchange rates are significantly better than banks.

What also makes OFX stand out from the rest of the competition is it's 24/7 telephone support service - perfect for online merchants and suppliers transacting all day and night.

- Integration with Xero

- Lock in exchange rates using a forward exchange contract

- Fee-free and better exchange rates for larger amounts

- OFX Global Currency Account for online sellers

- 24/7 customer service and resource hub for online sellers

- They’re not as competitive if you’re sending less than NZ$2,000

- Minimum transfer amount of NZ$250

- You can’t pay for your transfer using cash, credit card or a cheque

- Foreign currency account limited to online sellers

International money transfer reviews

If you want to send money abroad, we’ve listed some of the very best online money transfer services above. You’re not limited to those choices though — there are many financial service providers that will offer to send currency overseas, all with differing fees, exchange rates and services.

We’ve reviewed all of these providers and you can find links to all of these reviews below.

Transferring money internationally through your bank?

Banks are almost always more expensive than companies that specialise in overseas transfers even if they can be more convenient. They charge high fixed fees and worse exchange rates than you can get from companies like Wise (formerly known as TransferWise), XE Money Transfer, WorldRemit and similar businesses. It's really easy to make the switch - try it now.

Why do international transfer fees vary?

You’ll notice that the international transfer fees for sending a payment from New Zealand can vary pretty significantly. Different providers have their own fee structures, which might include more than one type of charge. When you’re choosing a provider to send money overseas you’ll need to look out for a few different costs:

- The provider’s transfer fee

- An exchange rate markup

- Third party costs

While the transfer fee itself is usually easy enough to spot, the other fee types may be a bit trickier. An exchange rate markup is an extra percentage charge which is added onto the rate used to convert your currency - you’ll need to compare the provider’s rate against the mid-market rate you’ll find on Google to spot this cost. Third party costs don’t go to the provider itself - instead these are paid to intermediaries, your card issuer, or the recipient’s own bank.

Double check the fee structure for your preferred provider - or use an online cost comparison tool - to make sure you don’t end up paying more than you expect for your international transfer.

What is Needed for an International Money Transfer?

Let’s walk through what’s needed for an international money transfer. The exact steps may vary a bit based on the individual provider, but usually the process is fairly similar:

- Create an account with the provider online, in their app, by phone or by visiting a branch

- Get verified by showing or uploading your ID documents

- Model your payment by entering the amount you want to send and the currency

- Enter your recipient’s details following the provider’s instructions

- Pay by card, bank transfer or cash

- You’ll be able to track your transfer online or in the provider’s app

The details you need to have to hand for your recipient will depend on the type of payment you’re making. If you want the recipient to collect their money in cash you may only need their name. But if you’re sending a payment to their bank account, you’ll need their full bank details, including the account number, BIC/SWIFT and branch information.

How to send large amounts of money internationally

If you need to send a large amount of money internationally, your bank or provider might ask you to provide some extra paperwork to support your transfer. It’s common to need to show an extra ID document, and prove the source of the funds, for example, whenever you’re sending a high value overseas transfer.

Banks and international money transfer services need to complete additional verification checks when they process high value payments, to comply with financial rules here in New Zealand, and also around the world. Before you set up your payment it’s worth asking your chosen provider what they’ll need, so you’re sure you have all the paperwork you need organised in advance.

How long does it take to send money overseas?

How long it takes to send money overseas can vary quite a lot depending on the provider you use, and where you’re transferring money to.

Sending an overseas SWIFT payment with your bank may take 3 - 5 working days to arrive, but specialist services can often process transfers faster as they use more modern payment networks. If you’re sending money for cash collection, and pay with cash or using a card, the funds may be available for your recipient almost instantly. Transfers to bank accounts can also arrive quickly depending on the payment route - delivery times from a few minutes to 24 hours are common, with most providers offering their own delivery estimates when you set up your transfer.

Compare a few different payment options to see which is fastest for your particular transfer.

How do I safely transfer currency internationally?

To make sure your international money transfer is safe, you’ll want to pick a trusted provider which has a good reputation and is properly regulated. The good news is that all the money transfer services we feature on The Currency Shop are safe to use, to make it easier to find the best way to send money overseas in just a few clicks.

The fastest way to find the smartest deal

Join over 10,000 monthly users saving thousands by finding and comparing exchange rates and fees for their next global adventure or international money transfer. All it takes is a few taps or clicks to compare and select the lowest fees and rates available.

$1.75M saved &

counting

More than 100,000 satisfied visitors have saved over $1.75M on currency so far.

Never get ripped

off again

We've partnered with the largest, safest and most trusted money currency brands in the world.

No added costs,

no mark up

Our referral fees don’t affect what you pay. Our exchange expertise is 100% free.

Make smarter

decisions

Explore our growing currency resources and make confident buying decisions.

Our frequently asked questions

Why should I choose The Currency Shop?

Many people are not aware of the true cost of transferring money. But it is pretty standard to lose up to 8% of your money each time you transfer money internationally, depending on your method. We think this is far too much. That’s why we help you find the best way to transfer your money and avoid those costly hidden fees and charges. And it works. On average, we save our customers $4,000 each year.

How does it work?

It’s pretty simple. Whether you need travel money or would like to transfer money overseas we just need a little info to point you in the right direction. First, you tell us what you are looking for then we compare hundreds of providers to find the best deal for your current situation. We’ll highlight all the available options and recommend the best one for you. You can then decide which option you prefer, and click through to their site to secure the deal.

Is it safe?

Yes. The Currency Shop holds an Australian Financial Services Licence (462269) and is a member of the Financial Ombudsman Service. We closely vet our providers and only partner with the largest, safest and most trusted money transfer companies in the world. That just makes sense.

What does it cost?

The Currency Shop does not charge you. Instead, we receive a referral fee from the banks and money transfer companies that we are partnered with. This does not affect the price you pay.

Want to find the best time to transfer?

Simply use our free email alerts to track the rate daily. Or set the rate you want and we'll email you when it's time to buy.

Your currency knowledge centre

How to Send Money Cheaply from Australia in 3 Steps

Looking to send money from Australia, then take a look at our latest review that provides the cheapest, fastest and best option for large amounts.

- Read more ⟶

- 5 min read

XE Money Transfer

Our latest review

In our XE Money Transfers review, we have a look at the services they offer and lay out the reasons we do (and sometimes don't) like them.

- Read more ⟶

- 3 min read

Wise Review Including the Borderless Account

Our biggest, most comprehensive look at one of the most popular money transfer companies in the world. All the information you need to make the right decision.

- Read more ⟶

- 8 min read