TorFX Review: All You Need to Know 2026

TorFX is a currency specialist which offers international payments in 40 currencies, to 120+ countries from New Zealand. You can arrange your transfer online or in the TorFX app, or call the customer service team, to send payments with no upfront transfer fee.

This guide walks through all there is to know about TorFX, including the currency exchange fees, whether it’s safe to use, how fast it is, how to get set up, and more.

TorFX: Key points

Key features:

- Send money in 40 currencies, to 120+ countries

- No TorFX transfer fees – exchange rate fees apply on all payments, in the form of a markup

- Forward contracts and market orders available for individual and business customers

- Local New Zealand phone service option – most services are offered via the TorFX Australia office

Key stats:

- Founded in 2004

- Send payments in 40+ currencies to 120 countries

- 425,000+ customers globally

- Part of a group processing 12 billion AUD+ in currency transfers annually

- 550 staff across several global offices, including in Australia

- Licensed in Australia and regulated in other countries as required by law

| TorFX pros | TorFX cons |

|---|---|

| ✅ Payment and currency risk management services available

✅ No TorFX transfer fee |

❌ Exchange rate markups apply

❌ You can’t get a quote for the rate offered without registering an account ❌ No card, cash or cheque payments available |

Overall: TorFX offers a range of international payments for personal and business customers. You can send a one off or recurring transfer and get currency risk management products like forward contracts if you’re concerned about avoiding the risks of currency fluctuations.

TorFX has a local New Zealand contact number which allows you to set up transactions by phone, which can be reassuring when sending high value transfers. However, to see the overall costs of using TorFX you’ll need to set up an account and get verified, as rate information is not available online without an account. That can make TorFX a bit tricky to compare to other services without handing over your personal and contact details.

What is TorFX?

TorFX is a currency specialist which offers services online or via their app, as well as by phone if you’d rather. It’s been around for over 20 years, and is part of a major international group processing billions of dollars of payments annually. Services in New Zealand are offered through the TorFX Australia website, but there’s a local New Zealand contact number if you need phone support.

Services are available for both business and personal customers. Here’s what you can do with TorFX:

One off and recurring international transfers

Send TorFX international transfers online, in app or by phone. There’s no TorFX transfer fee, but you’ll still need to get a quote for the TorFX exchange rate for your currency before paying by bank transfer. There’s no upper limit to how much you can send with TorFX.

Great for: Individuals and businesses sending international transfers on a one-off or recurring basis.

Forward contracts

Forward contracts lock in an exchange rate for future payments which can be helpful if you have an upcoming foreign currency bill and want to be certain what it’ll cost in NZD. Products like these do involve some risk, so you’ll need to talk to a broker to get set up.

Great for: Anyone looking to fix the exchange rate on future international payments, to avoid surprise costs if the rate changes suddenly.

Market orders

Market orders are another currency risk management product which can allow you to either buy currency when a desired rate is achieved, or sell if a rate hits a pre-agreed level. This can help you either buy at the best available rate over a period of days or weeks, or sell assets, to protect you from sharp or sudden decreases in the value of your currency holdings.

Great for: People targeting specific exchange rates to buy or sell currency.

Business FX services

TorFX also offers these services to business clients looking to save money on international payments. The TorFX team can also help you identify where your international payment processes could be streamlined, to help cut costs and improve your profits.

Great for: Businesses working internationally and looking to cut the costs and mitigate risks of currency exchange.

Is TorFX available in New Zealand

Yes. TorFX operates through its Australian website when processing transfers to and from New Zealand. There’s a local New Zealand phone line, and you can send money to 120 countries from New Zealand conveniently.

How does TorFX work?

TorFX offers services once customers have registered online and been verified. There’s no TorFX transfer fee but there is an exchange rate markup, which is a fee added to the rate used to convert from NZD to the currency needed.

Ways to send money with TorFX:

- Send a one off or recurring payment

- Arrange your transfer online, in app, or by phone – high value payments and currency solutions can only be arranged by phone

- The sender will need to register a TorFX account

- The recipient does not need a TorFX account – funds are deposited to their bank

Is TorFX safe to send money?

TorFX offers services through its Australian entity, which is AUSTRAC licensed and regulated, and which holds an Australian Financial Services licence covering its business activities. It is a safe service to use, backed by a large organisation which specialises in digital currency services.

TorFX pricing

TorFX does not charge a transfer fee for international payments. Instead, there’s a small margin added to the exchange rate used for payments. In addition to this, TorFX advises that third party banks may charge their own fees when processing payments for TorFX – this may mean your recipient gets less than expected in the end.

TorFX exchange rate

The TorFX exchange rate is calculated by adding a margin – also known as a markup or a currency spread – to the mid-market exchange rate. Before you can compare this rate against other providers you’ll need to register with TorFX to get a quote online or by phone for the available exchange rate for your specific payment.

How long does a TorFX transfer take?

TorFX payments can arrive on the same day they’re processed for major currencies, or within 2 working days for exotic currencies. As with most money transfer services, the currency, destination country, and the processes in place at the receiving bank all impact the ultimate length of time it takes for your money to arrive in the recipient’s account.

How to use TorFX

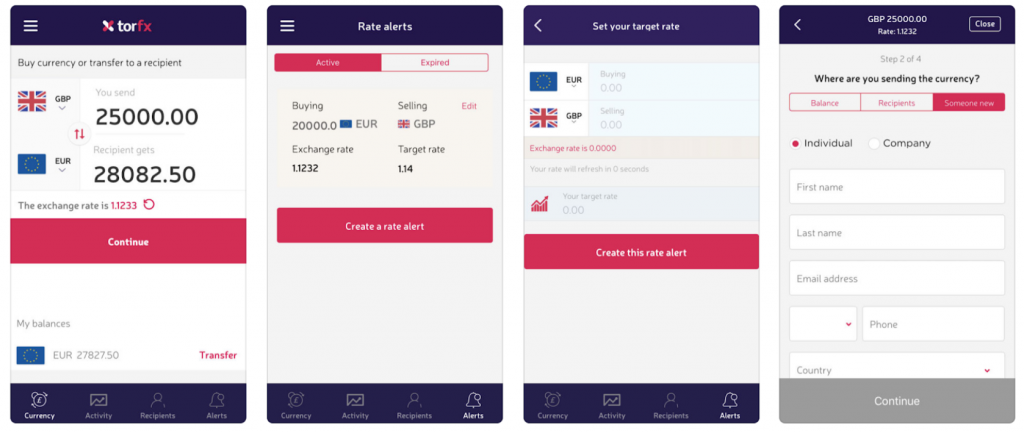

You can use TorFX through an app, online and by phone. To get started you’ll need to set up and verify a TorFX account. This will usually require you to talk to a member of the team by phone to discuss your needs and complete the verification process.

How to send money with TorFX

Once your account is registered and verified you should be able to send lower value payments in the TorFX app or on the desktop site:

- Log in on the TorFX desktop site, or open the app

- Enter the country you want to send to

- Enter the transfer amount to generate an exchange rate quote

- Confirm the payment and fund it by bank transfer

- The payment will be processed once TorFX receive the funds

The details you’ll need when you’re sending money

You’ll need to enter the following details when you set up your TorFX payment – or give them to the customer service team member by phone if you’re arranging your transfer that way:

- Your recipient’s name as shown on their bank account

- Your recipient’s bank name and address

- Your recipient’s bank account number

- Your recipient’s bank SWIFT/BIC code

TorFX payment methods

Once you’ve agreed an exchange rate for your TorFX transfer you’ll need to fund the payment – usually payments are funded by bank transfer.

Payout methods

When you send money with TorFX it will be deposited into your recipient’s bank account directly.

How to track TorFX transfer

Download the TorFX app to track your transfer – or give the team a call on the local New Zealand contact number.

How to create an account

You’ll need to talk to a TorFX currency specialist to complete your account verification process – here’s what to do:

- Register your account online by completing your personal details

- Wait for a call back from a TorFX currency specialist

- Get verified by uploading documents to support your application

What documents you’ll need

The verification documents that can be accepted can vary a little depending on the account type and your needs – but usually you’re asked for a proof of ID like a passport or driving licence, and a utilities bill or similar as proof of address.

Additional documents are needed for a business account – you’ll be guided through the process when you apply for your account.

How long does TorFX verification take?

You’ll need to talk to a member of the TorFX team to get verified – they’ll be able to advise the likely time it’ll take based on the specific documents you’ve provided.

Do I need a bank account for TorFX?

TorFX offers payments which move from your New Zealand bank to another bank account overseas. Both you as the sender, and your recipient, will need a bank account to use the international payment services available from TorFX.

How to receive money from TorFX?

Payments through TorFX will be deposited into your bank account directly. Just give the person sending your money your bank account information and wait for the transfer to arrive.

TorFX limits

There are no upper limits to the amount you can send with TorFX, but personal payments worth over 50,000 AUD and business payments of over 200,000 AUD need to be arranged by phone.

Supported currencies

TorFX supports payments in 40+ global currencies, to 120+ countries.

TorFX reviews

TorFX global scores an average of 4.9 stars on Trustpilot, from a total of over 7,200 listed reviews at the time of writing. The TorFX Australia site scores 4.8 stars, from 2,600+ reviews. In both cases, that’s an excellent rating on the Trustpilot scale.

Happy customers comment on the fast phone service from named brokers, and the ease of use overall. Where customers are less positive, one common complaint is that you can’t get a quote for the exchange rate available without registering an account, which requires you to hand over lots of personal information and upload ID. This can be off putting to customers who aren’t sure if it’s the right service for their specific needs.

TorFX accessibility

TorFX is available online and in app on both Apple and Android phones. You can also call the TorFX team, on a local phone number. For some high value or complex currency transactions you may need to talk to a team member directly rather than making arrangements electronically.

TorFX customer service

You can call TorFX 24/7 on:

TorFX New Zealand – 0800 441 283

Alternatively, you can use the email form which is available on the TorFX Australia website.

TorFX alternatives

TorFX vs Wise – Wise offers international payments for individuals and businesses, to 160+ countries. There’s no markup – you get the mid-market exchange rate and pay just low transparent fees.

TorFX vs Western Union – Western Union has a network of agents as well as online and in-app services. Payouts available to bank accounts or for cash collection, can be a good TorFX alternative if you need to send money to someone with no bank account

TorFX vs PayPal – send instant payments at home and abroad – convenient and quick, but not always the cheapest. With PayPal your recipient will also need to set up an account to get their money.

TorFX vs Revolut – open an online international account to send money globally, with some no fee currency conversion every month

TorFX for business

TorFX extends all of its services to businesses as well as individual customers, and also has a few business friendly extras. Services offered include:

- International payments to 120+ countries

- Currency risk management services

- No transfer fees

- 24/7 phone support by brokers

- Currency analysis for your business to minimise conversion costs

Conclusion: Is TorFX a good way to transfer money?

TorFX has services for individuals and business customers looking to send payments or manage the risks of currency exchange fluctuations. You can make payments digitally, and there’s a 24/7 phone option as well, which can mean this service is preferred by people looking for reassurance when sending high value payments, or setting up complex products.

TorFX doesn’t offer exchange rate information until you register an account and get verified – a common complaint over on Trustpilot. However, it does have very high ratings from existing customers, which may make it worth comparing if you’re happy to hand over your personal and contact information to get a quote.

TorFX money transfer review FAQs

Is TorFX legit?

Yes. TorFX is a legit global service, which offers payments in New Zealand through its Australian entity, which is AUSTRAC licensed and regulated, and which holds an Australian Financial Services licence covering its business activities.

How much does TorFX cost?

There’s no TorFX transfer fee, but there is an exchange rate markup, which is a fee added to the conversion rate to change your NZD to the currency needed for depositing.

How long does TorFX take to transfer funds?

TorFX payments can arrive on the same day they’re processed for major currencies, or within 2 working days for exotic currencies.

Is it safe to transfer money with TorFX?

Yes. It is a safe service to use, backed by a large licensed and regulated organisation which specialises in digital currency services.

How does TorFX apply exchange rates?

TorFX adds a margin to the mid-market exchange rate, to generate an exchange rate for international payments. You can’t see the rate available for your payment until you register an account and get verified.

Does TorFX have a mobile app?

There’s a TorFX app available on Apple and Android phones.

How does TorFX work?

Register with TorFX online, in app or by phone, and get verified to send one off or recurring payments, and access specialist foreign exchange and currency management solutions for individuals and businesses.

How many currencies does it support?

TorFX supports payments in 40+ global currencies, to 120+ countries.