How to use Kiwibank card abroad – 2026

If you have a Kiwibank account you may already have a Visa Debit card for home use. But what about when traveling internationally? Can I use my Kiwibank debit card overseas and if so what does it cost? This guide has you covered.

In this article, we’ll explain how to use a Kiwibank card when travelling overseas, the fees involved, the withdrawal limits, and some useful tips to save money when spending abroad. Plus, as a bonus, we will introduce several alternatives including Wise which could be cheaper and more flexible.

Can I use the Kiwibank card abroad?

Yes. You can use the Kiwibank card abroad wherever the Visa network is supported, for spending and cash withdrawals. Fees may apply, which can make overseas spending more expensive than buying things in NZD. More on that in this guide.

Not sure how to spend when you’re overseas? Learn more about the best ways to buy travel money before your next trip.

How to use Kiwibank card overseas

The Kiwibank Debit Card is linked to your preferred Kiwibank account and can be used for overseas spending and withdrawal. You’ll use your card just as you would at home, to make cash withdrawals, contactless payments, Chip and PIN payments and mobile payments if you use a service like Apple Pay. However as the costs can be different it’s important to get familiar with the Kiwibank international fees and rates before you travel.

You’ll also need to take a moment to notify Kiwibank before you travel to ensure your card isn’t blocked when it’s used internationally.

About Kiwibank card

The Kiwibank card is a Visa Debit Card which is linked to a Kiwibank account. You can link your card to several different Kiwibank everyday accounts, which gives flexibility for you to find the account option which best suits your specific needs. Some accounts may have associated ongoing or transaction fees, so compare your options carefully.

Once you have your card linked to Kiwibank you can spend from your balance at home and abroad, including:

- Make cash withdrawals from ATMs

- Tap and make contactless payments

- Add your card to a mobile wallet for mobile payments

- Use Chip and PIN for higher value transactions

Prefer to use cash when you travel? Check out this review of Travel Money NZ as one good option for travel cash.

Fees for using Kiwibank card abroad

There’s an annual fee for a Kiwibank card, of 10 NZD. This is waived in the first year. While there’s no card issue fee, there are delivery fees for a replacement card, from 15 NZD – 50 NZD depending on the situation. In this guide we’re specifically looking at the costs of using the Kiwibank card overseas, but it’s also worth scrutinising the other account and card fees which you’ll pay when you use Kiwibank so you know what to expect.

Does Kiwibank card have foreign transaction fees?

Yes. When you use a Kiwibank card to spend or withdraw in a foreign currency you pay a foreign transaction fee of 2.5% of the transaction amount. This applies when you spend in person during an overseas trip, or when you spend online and pay in a foreign currency.

Not all card providers have a foreign transaction fee. If you’re using your card for frequent overseas payments you may find you’re better off with a card like the Wise Card which has no foreign transaction fee and can be cheaper for international use overall.

What is the currency conversion rate for Kiwibank cards?

When you spend overseas, the currency conversion rate for Kiwibank cards is set by Visa. Your payment is converted to NZD using this rate, plus the 2.5% foreign transaction fee. This means that spending overseas may end up more expensive than you expected once converted back to dollars.

What are the overseas ATM withdrawal fees for the Kiwibank card ?

There are various different overseas ATM fees for Kiwibank cards, depending on the type of transaction:

- Kiwibank card overseas ATM withdrawal fee: 6 NZD + 2.5% foreign transaction fee

- Kiwibank card overseas ATM inquiry fee: 1 NZD

- Kiwibank card overseas ATM transaction decline fee: 1 NZD

Spend and withdraw overseas with low overall costs: Wise

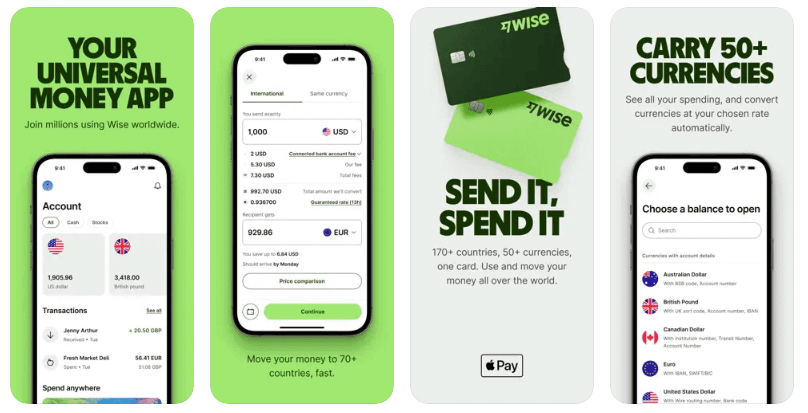

Open a Wise account and order a Wise card to spend in 150+ countries conveniently and with no ongoing card or account fees. Wise accounts let you hold, send, spend and exchange 40+ currencies, with no foreign transaction fee for card use. You can add money in NZD or your preferred currency and convert to the currency you need with the mid-market rate and no hidden fees. Instead there’s a small conversion fee which is split out for transparency, from 0.23%.

There’s no fee to spend a currency you hold in your Wise account and if you don’t have the currency you need, the card can manage the conversion for you with the mid-market rate and the same low Wise conversion fee.

How to withdraw money abroad with a Kiwibank card

You can withdraw money abroad with a Kiwibank card in the same way you would at home – just remember that the fees are different. Here’s how to withdraw money abroad with a Kiwibank card:

- Find an ATM which displays the Visa logo

- Insert your card and enter your PIN

- Follow the prompts to enter the amount of money to withdraw

- Wait for your card and cash to be dispensed

| 💡 Key point: |

|---|

| The Kiwibank card can be used more or less anywhere in the world where the Visa network is accepted, making it a convenient option for spending and withdrawing cash as you travel. Fees apply, including a foreign transaction fee and an international ATM fee. |

Kiwibank ATM withdrawal limits

The Kiwibank ATM withdrawal limit is 2,500 NZD/day. ATMs may have limits which are far lower than this.

You can view and adjust your limits in the Kiwibank app or by calling the bank.

How do I put money on my Kiwibank card?

You can use your Kiwibank card to spend the funds you hold in your Kiwibank account. Add money to Kiwibank by bank transfer or deposit, including incoming overseas payments if you choose.

Is it safe to use the Kiwibank card abroad?

Kiwibank is safe to use and a fully licensed and regulated New Zealand bank. You’ll need to take normal precautions with your card, such as protecting your PIN and keeping your account information secret, but aside from this, it should be safe to use the Kiwibank card abroad.

How do I activate my Kiwibank card outside New Zealand?

Activate your Kiwibank card by inserting it into an ATM and entering your PIN. Or if you prefer, you can activate your card using internet banking:

- Log in to internet banking.

- Click on your card.

- Select ‘Additional Options and Details’.

- Next to ‘Card Status’ select ‘Activate’.

3 Alternatives to Kiwi card for overseas use

If you’d prefer a dedicated travel card for overseas use, you have a few other options. Cards which have been optimised for travel may allow you to make lower cost international payments and withdrawals. Here are a few options to consider:

Wise Card

You can open a Wise account online or in the Wise app and get a Wise Debit card for 14 NZD.

The Wise account is a multi-currency account which supports 40+ currencies for holding and exchange, and currency exchange uses the mid-market rate with low, transparent conversion fees from 0.23%.

Spend online and in person with WIse, including mobile payments with a free virtual card, and make 2 withdrawals to the value of 350 NZD/month with no Wise fee, then 1.5 NZD + 1.75%.

Travelex Card

The Travelex Travel Money Card can hold 9 currencies and offers international spending and cash withdrawals. Just add some money in NZD, and convert to the currency you need using the Travelex exchange rate. There’s then no fee to spend a currency you hold – but there is a 4% foreign transaction fee if you spend a currency you don’t hold – so do remember to convert before you travel to avoid this charge. Travelex exchange rates may include a fee.

You can also use your Travelex card for ATM withdrawals with no fee, but bear in mind that the ATM might have its own charges.

OneSmart Card

The OneSmart card is issued by Air NZ and supports 9 currencies for holding and exchange. There’s no fee to spend a currency you hold already in your account but there are conversion costs of 2.5% if you spend a currency you don’t already hold. You’ll also need to pay a monthly charge of 1 NZD, and some ATM fees depending on the currency and how often you withdraw.

The key upside for the OneSmart card is that you can use it to earn New Zealand AirPoints Dollars as you spend with your OneSmart Card, at the rate of one Dollar per 100 NZD spent overseas. This can make it a popular choice with frequent flyers.

Use Google Pay or Apple Pay and spend with your phone

You can use your Kiwibank card alongside Google Pay or Apple Pay and spend with your phone conveniently, at home and abroad.

Just add your card to your preferred wallet to make payments with your phone wherever contactless is accepted. The exact way that each wallet works depends on the type of phone you have, but usually you’ll need to look for your Wallet feature in settings, or the Wallet app, to add your card following the onscreen instructions. You can then use your phone like a card to tap and pay in stores.

Which countries can I use my Kiwibank card in?

You can use a Kiwibank card anywhere the Visa network is accepted, including overseas. There are usually only a few countries where Visa can’t be used, which is generally because of global financial sanctions.

Are there any countries where the Kiwibank card doesn’t work?

At any given time, there may be a few countries where the Kiwibank card doesn’t work due to global sanctions. This list does change over time, so you’ll need to check the latest on the Kiwibank website or ask a member of staff if you’re unsure.

Tips for saving money when spending abroad

Before we finish up, let’s look at a few handy tips for spending money when you travel:

- Always pay in the local currency of the country you’re in – you may be asked if you would prefer to use NZD but this means paying a higher overall fee

- Check the foreign transaction fee which applies to your card before you travel to make sure there are no surprises

- Inform Kiwibank that you’re about to leave the country before you go, or your card may be blocked for fraud prevention reasons

- A dedicated travel card from a provider like Wise may give you more flexibility to spend when overseas, and lower overall costs

Conclusion: Is Kiwibank a good travel card?

When you use your Kiwibank card overseas, or to spend in a foreign currency online, you’ll pay a 2.5% foreign transaction fee on all spending. There’s also a higher fee for ATM use when you’re away from home. This can mean that spending overseas with Kiwibank is more expensive than you expect.

Getting a dedicated travel card from a service like Wise can help you manage your costs and budget more effectively, with no foreign transaction fee and ways to hold and exchange 40+ currencies in one account.