Wise travel card review [2023]

Getting a travel money card is a smart move when you’re headed overseas.

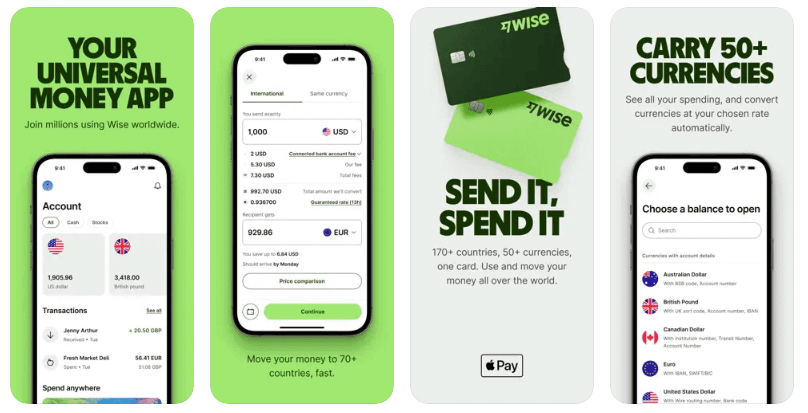

The Wise travel card is linked to a multi-currency Wise account which can hold 40+ currencies, and lets you convert from one currency to another with the mid-market exchange rate. You can use your Wise travel card in 140+ countries, which makes this a super flexible and versatile travel card option, even for frequent travellers and those who like to get off the beaten track.

This guide covers all you need to know about how the Wise card works, with a look at key benefits and fees. We’ll also touch on a couple of popular alternatives for New Zealand travellers, the ANZ debit card and the Westpac travel money card, so you can compare them and see which works best for you.

Wise travel card: key features

The Wise card offers some great features which aren’t available from all New Zealand travel money card providers, including a linked account you can use to hold and exchange 40+ currencies, and local account details for up to 9 currencies, in case you also need to receive money from others in foreign currencies. However, it’s not perfect, so there are a few drawbacks to know about as well.

We’ll go through how the Wise travel money card works in detail, and look at features, fees and limits, in a moment. First, an overview of some of the Wise travel card pros and cons:

| Pros | Cons |

|---|---|

| ✅ Hold 40+ currencies

✅ Spend in 140+ countries ✅ Currency exchange uses the mid-market rate with low, transparent fees ✅ Send money to 160+ countries ✅ Google and Apple Pay compatible for mobile payments ✅ Safe provider, with 16 million+ customers worldwide |

❌14 NZD card order fee

❌Some ATM fees apply once you’ve used your monthly free withdrawal allowance ❌No branch network – you’ll need to order your card online or in the Wise app |

You can either top up in dollars and switch to the currency or currencies you need in advance of travel, or just let the Wise travel card do the conversion for you at the point of payment, with the mid-market rate and the lowest available fees.

Who is the Wise travel card for?

The Wise travel card is available for both personal and business customers, and your account can be entirely opened and managed online or in the Wise app. That makes it handy for a range of people:

- Frequent travellers who need to spend in any of the 140+ supported countries

- Individuals, business owners and entrepreneurs who want to hold and exchange 40+ currencies

- Anyone who likes to convert their NZD to the destination currency in advance to set their travel budget before they leave

- People paying or getting paid from overseas – for example if you have income from an overseas holiday rental, or need to pay a mortgage on your property abroad

- Business owners who want to issue travel cards to their team members for overseas expenses

- Online shoppers spending with international retailers

- Anyone who wants to view and manage their account and card online or in-app

What is the Wise travel card?

The Wise travel card is a convenient prepaid debit card linked to a multi-currency Wise account. You can hold 40+ currencies in your account, and top up or exchange right from your phone. Switch your balance to the currency you need in advance, or just let the card’s auto convert feature do it for you at the point of payment, with the mid-market exchange rate and the lowest available fees every time.

Wise accounts are available for business and personal customers, and also offer handy extras like options to receive payments like a local from 30+ countries, send payments to 160+ countries, and easy account management through the Wise app. Business customers can also get time saving tools like batch payments and accounting integrations.

Is the Wise Travel Money a multi-currency card?

Yes. The Wise account and travel money card have powerful international features which make them perfect for anyone who wants a multi-currency card and account. You can hold 40+ currencies, including a broad selection of major world currencies, and plenty of less common currency options, too. And you can spend around the world – over 140 countries are covered, with in person, online and mobile payments, and cash withdrawals as and when you need them.

Alternatives to Wise travel card

The Wise card isn’t right for everyone. Fortunately, New Zealand customers have a really broad selection of travel card options, including providers like ANZ and Westpac which also have travel cards optimised for overseas spending.

Here’s a quick overview of how these providers line up on some key features:

| Wise travel card | ANZ debit card | Westpac travel card | |

|---|---|---|---|

| Availability | Order online or in-app | Order online or in a branch | Order online |

| Card order fee | 14 NZD | No fee | No fee |

| Monthly fees | No fee | No card specific fee – but fees may apply on your underlying ANZ account | No fee |

| International Money Transfers | Fees from 0.43%, 140+ countries covered | 9 NZD online, 28 NZD in branch or by phone | Not available with the card – you’ll need a full Westpac account to access this service |

| ATM withdrawals | 2 withdrawals to 350 NZD/month fee free, then 1.5 NZD + 1.75% after that | No fee for international withdrawals | No fee for international withdrawals

4 NZD local withdrawal charge |

| Currency Exchange | Mid-market rate | Rates include a 1.3% foreign transaction fee | Westpac rate which may include a markup |

| Fee to spend a currency you don’t hold in your account | From 0.43% | Rates include a 1.3% foreign transaction fee | 2.95% on top of the Mastercard rate |

| Supported Currencies for holding and exchange | 40+ currencies supported | NZD only | 9 currencies supported |

| Business Accounts | Available | Alternative ANZ business services offered | Alternative Westpac business services offered |

Information taken from Wise pricing page, Westpac travel card desktop site and fee information, ANZ money transfers and ANZ New Zealand; correct at time of writing, 27th July 2023

Whether Wise or an alternative provider like ANZ or Westpac suits you best will depend a lot on your personal preferences. Wise and Westpac both offer specific travel cards, while ANZ recommends using their standard Visa debit card or EFTPOS card overseas.

If you want a specific travel card, Wise has a very broad range of supported currencies, with low fees and mid-market currency exchange, while Westpac is a familiar name with no card order fee. If you’re happier just using your normal bank card when you travel, and already hold an ANZ debit card, using this attracts a fairly low 1.3% foreign transaction fee, with no hassle to get started.

ANZ

ANZ doesn’t have a specific travel card for foreign currency holding, but instead recommends customers just use their normal debit or EFTPOS card when they’re abroad. This has the advantage that you don’t need to order a new card specifically for your trip. However you’ll pay a 1.3% fee whenever you spend or withdraw in a foreign currency which can push up costs overall.

Read more about ANZ Travel Card

Westpac

Order a Westpac Global Currency Card online for home delivery, and top up in NZD to convert to any of the 9 supported currencies for spending abroad. There’s no international ATM fee although individual ATM operators might charge their own fees which can’t be waived by Westpac. If you’re spending a currency you hold in your account there’s no foreign transaction fee – but if you spend an unsupported currency or if you don’t have enough in your balance to cover a specific purchase, a 2.95% fee applies.

Read more about 4 best travel debit card for overseas travel

Wise travel card fees & spending limits

There are a few fees and limits to consider if you’re thinking of the Wise travel card in New Zealand.

If you have a Wise New Zealand account there’s usually no limit to how much you can hold in your Wise account. However, there are limits – for security reasons – to the value of transactions you can make, on a single transaction, daily and monthly basis.

Firstly let’s look at the important limits that apply:

| Transaction type | Single transaction limit | Daily limit | Monthly limit |

|---|---|---|---|

| Chip and PIN or mobile wallet like Apple Pay or Google Pay | Default: 4,300 NZD

Maximum: 17,500 NZD |

Default: 5,300 NZD

Maximum: 17,500 NZD |

Default: 17,500 NZD

Maximum: 52,500 NZD |

| ATM withdrawal | Default: 1,750 NZD

Maximum: 1,750 NZD |

Default: 2,700 NZD

Maximum: 2,700 NZD |

Default: 5,250 NZD

Maximum: 7,000 NZD |

| Contactless | Default: 900 NZD

Maximum: 900 NZD |

Default: 900 NZD

Maximum: 1,750 NZD |

Default: 7,000 NZD

Maximum: 7,000 NZD |

| Magnetic stripe | Default: 550 NZD

Maximum: 2,100 NZD |

Default: 700 NZD

Maximum: 2,100 NZD |

Default: 2,100 NZD

Maximum: 10,500 NZD |

| Online purchase | Default: 1,750 NZD

Maximum: 17,500 NZD |

Default: 1,750 NZD

Maximum: 17,500 NZD |

Default: 3,500 NZD

Maximum: 52,500 NZD |

All information correct at the time of writing – 27th July, 2023.

As you can see, there’s a default limit per payment type, and a maximum. Your Wise account will initially be set to the default limits – but you can adjust caps anywhere up to the maximum allowed, in the Wise app.

Next, let’s walk through the fees you’ll pay to receive and use your Wise travel card:

| Service | Wise debit card fee |

| One time card order fee | 14 NZD |

| Optional express delivery – get your physical card in 1 – 2 days | From 17.4 NZD |

| Digital card | Free |

| Order a new card | 10 NZD |

| Replace an expiring card | Free – Wise will remind you when you need a new card for convenience |

| Spend currencies you hold in your account | Free |

| Spend in currencies you don’t have in your account | Wise will auto convert the balance you have to the currency you need, using the mid-market exchange rate and the lowest available fees |

| First 2 ATM withdrawals a month, up to the value of 350 NZD | Free |

| Additional withdrawals, over the value of 350 NZD/month | 1.50 NZD per withdrawal + 1.75% of the withdrawal value |

All information correct at the time of writing – 27th July, 2023. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Exchange rates

Wise currency exchange uses the mid-market exchange rate, with a low and transparent fee from 0.43%. You’ll be able to see the exchange rates available in the Wise app, and double check the fees, before you switch currencies. Once you have the currency you need for spending or withdrawals in your account, there’s no Wise foreign transaction fee.

How to get Wise travel card

To get your Wise travel card you’ll first need to open a Wise account online or in the Wise app using your email address, Facebook, Apple or Google ID. Once your account has been verified, you can top up your Wise account balance in dollars (or one of the other 20 or so supported currencies for loading funds).

Within the Wise app you can then order your Wise card, to start spending with your digital card right away.

What documents you’ll need

When you open your Wise account you’ll need to provide some documents for verification purposes. This is to keep your account secure and to comply with local and international law – but the whole process can be done right from your phone. You’ll be guided through what’s needed based on your account type – usually that’ll mean uploading images of:

- Your proof of ID – such as your passport

- Proof of address – like your driving licence or a utility bill

What happens when the card expires?

Once your Wise card is coming close to its expiry date you’ll be notified, and Wise will send you a new card automatically for free.

How to use the Wise travel card?

The Wise travel card is issued on major global networks like Visa and Mastercard, so it’ll be accepted in most countries around the world. Plus you can add your card – or a Wise virtual card – to Google Pay and Apple Pay for convenient mobile payments at home, online and when you travel.

How to withdraw cash with the Wise travel card?

You can use the Wise travel card to make cash withdrawals at a broad selection of ATMs around the world – just like you would your regular card. If you find you’ve forgotten your PIN, don’t worry. You can also double check this by securely logging into the Wise app and accessing your card details.

Is the card safe?

Yes. The Wise travel card is safe to use. Wise has been established since 2011 and is fully licensed and regulated for the services it provides globally. In New Zealand, Wise is overseen by the DIA.

How to use the Wise travel card overseas?

You can use your Wise card for spending and making withdrawals in 140+ countries around the world. In most cases, where you can’t use your Wise card it’s as a result of global sanctions or financial regulations – there’s a list of the countries where you can’t use your Wise card over on the Wise website if you need to check.

Conclusion: Is the Wise travel card worth it?

The Wise travel card is a helpful option for anyone who would like to hold a multi-currency account and spend easily around the world. Because Wise supports a pretty impressive 40+ currencies, the card is super flexible, and all currency exchange uses the mid-market exchange rate with low fees from 0.43%.

Compare Wise to another card or two that are available on the New Zealand market, like the ANZ debit card and the Westpac Travel Money Card, to see which suits you best.

Wise travel card review FAQ

How does the Wise travel card work?

Open a Wise account online or in the Wise app, and order your Wise travel card for a one time fee of 14 NZD. You can then use the card to spend in 140+ countries, with the mid-market rate and low fees from 0.43%.

Is the Wise travel card an international card?

Yes. The Wise travel card is linked to a Wise account which can hold 40+ currencies, and can be used for convenient spending and withdrawals in 140+ countries.

Are there any alternatives to a Wise travel card?

Compare the Wise card against alternatives like the Westpac Travel Money Card which can hold and spend 9 currencies conveniently.