Best International Banks in New Zealand 2026

If you’re a newcomer to New Zealand, or living here as an expat or a digital nomad, an international bank account can help you hold, send, spend or receive foreign currencies, often with low fees. Different account types exist depending on whether you want to manage your money across currencies day to day, save and invest, or make overseas payments.

This guide covers the features and fees of international accounts from large banks in New Zealand, and also some non-bank options like Wise and Revolut, which can offer flexible and low cost ways to manage your money across currencies.

5 Best Banks for International Travel

Here are the top 5 banks we’ve picked out to profile, with accounts and services suitable for international travel for expats and digital nomads.

Wise Account: best for holding and exchanging 40+ currencies, with a linked debit card, no ongoing fees and mid-market exchange rates

Revolut Account: best for different account tiers including some with no ongoing fees, and no-fee transaction options based on account choice

Westpac Foreign Currency Account: best for saving and earning interest in a bank account with no ongoing fees

ANZ Foreign Currency Account: best for paying overseas bills and sending money internationally with ease

BNZ Foreign Currency Account: best for holding high value balances in foreign currencies, with interest increasing the more you save

What is an international bank account?

International accounts are available from both banks and non-bank alternative providers. While they have very varying features depending on the account you pick, what all these accounts have in common is that they’re optimised for international use.

New Zealand banks focus on foreign currency accounts for saving, earning interest and investing – often with pretty high balance requirements to earn interest or avoid ongoing fees. Accounts do not have linked cards, and are not meant for travel use – these products are best for savers and anyone building a foreign currency nest egg.

Non-bank providers like Wise and Revolut have multi-currency accounts with linked payment cards which you can use to hold, send, receive, spend and exchange dozens of currencies all in one account. These are better for day to day use, rather than interest earning, making them a good option for travellers and people sending and receiving multiple different currencies.

The benefits of international accounts vary widely depending on the specific product you select. Here are some features you might find:

- Hold balances in one or more foreign currencies

- Earn interest on your foreign currency savings

- Receive payments in foreign currency to your account conveniently

- Low or no foreign transaction fees when you spend with your card

- Favourable exchange rates may be available

Can you open an international bank account?

Yes, you can open an international bank account in New Zealand with certain banks and specialist providers like Wise and Revolut.

The options, features, fees and account opening processes can vary a lot depending on the provider you pick. We’ll cover more on this later on.

What is the best international bank?

There’s no single best international bank. In fact, instead of using a bank account you might decide to get an account from a non-bank provider instead – the right choice for you will depend on how you want to use your account.

Let’s start with an overview on each of our top picks and then we’ll explore more about the options available in detail. Later on, we’ll also cover what to consider when choosing an international bank.

| Wise | Revolut | Westpac | ANZ | BNZ | |

|---|---|---|---|---|---|

| Account opening fee | No fee for a personal account | No fee | No fee | No fee – but minimum deposit requirements are in place, varied by currency – 5,000 AUD or 5,00 GBP for example | No fee |

| Account maintenance fees | No fee | 0 – 19.99 NZD/month depending on account | No fee | No fee | Fees vary based on currency – for example, there’s a 13 AUD fee which is waived if you hold a balance of 125,000 AUD or more |

| Multi-currency Account | Supports 40+ currencies | Hold and exchange multiple foreign currencies | Multiple currencies offered – accounts designed to save one currency only | Multiple currencies offered – accounts designed to save one currency only | Multiple currencies offered – accounts designed to save one currency only |

| Travel Card (debit or credit) | Wise international debit card available | Varied debit cards available depending on the account tier | Not available | Not available | Not available |

| Foreign Transaction fees | No foreign transaction fee | No foreign transaction fee | Not applicable | Not applicable | Not applicable |

| Currency Conversion Rates | Mid market exchange rate + conversion fees from 0.43% | Mid market exchange rate to plan limit, then fair usage fees begin

1% out of hours conversion fee |

Westpac rates apple which may include a markup | ANZ rates apple which may include a markup | BNZ rates apple which may include a markup |

| Foreign ATM Transaction Fees | 2 withdrawals up to 350 NZD free/month, then 1.5 NZD + 1.75% | Some no fee withdrawals monthly based on account plan, then 2% fee | Not applicable | Not applicable | Not applicable |

| International Business Accounts | Available for freelancers and business owners | Not available in new Zealand | Business services available | Business services available | Business services available |

As you can see, each of the international account options we’ve chosen have their own features – making it likely that some will suit you better than others. We’ll dive into the details about each account in more depth next – here’s a quick summary of who may love these different account products:

Wise Account: Great for anyone looking for a low cost multi-currency account and card, with no ongoing fees and mid-market exchange rates

Revolut Account: Great for picking between different account tiers depending on how frequently you transact, with various no-fee transaction options based on account choice

Westpac Foreign Currency Account: Great for saving and earning interest – when diversifying a portfolio or sending money internationally often for example

ANZ Foreign Currency Account: Great for paying overseas bills and holding a balance for emergency costs in foreign currencies

BNZ Foreign Currency Account: Great for people holding high value balances in foreign currencies, who may be able to have fees waived and earn higher interest percentages on their savings

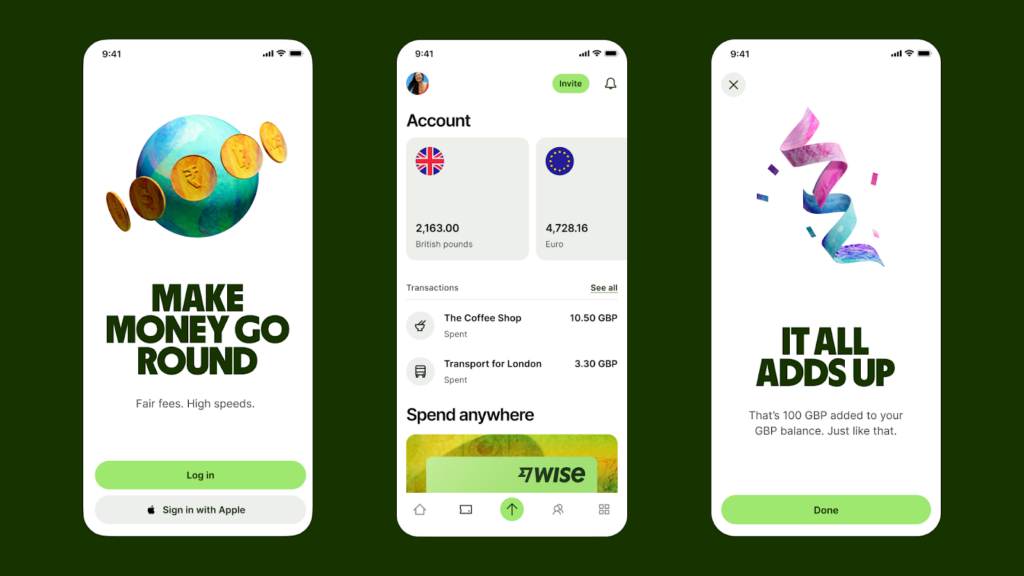

Wise Account

Open a Wise New Zealand account online or in the Wise app, to hold and exchange 40+ currencies and order a debit card for spending around the world. There are no ongoing fees and no minimum balance, and all currency exchange uses the mid-market exchange rate with low fees from 0.43%.

Accounts let you receive money in 9 currencies including NZD, AUD and more, and send payments to 160+ countries with mid-market rates and low, transparent fees. This means that you can use the Wise account to manage your money conveniently day to day, even across multiple currencies.

Wise account is best for: no monthly fees, 40+ supported currencies, and ways to get paid in 9 currencies by local transfer

Wise travel card: available for use in 150+ countries

Foreign transaction fees: no fee to spend a currency you hold; currency conversion from 0.43%

International ATM withdrawals: some free withdrawals every month, low fees after that

Revolut Account

Revolut has 30+ million customers globally and recently launched in New Zealand. All accounts offer multi-currency holding options and linked debit cards for easy spending and withdrawals – there are different account tiers so you can pick the one that suits your spending needs. Choose a plan with no ongoing fee, or trade up if you find you use your account more frequently.

Revolut accounts are managed from a mobile app, making them another good tool for managing your money across currencies on the move.

Revolut account is best for: varied plans suit your spending habits, including some with no monthly fee, and some with ongoing charges which unlock extra features

Revolut travel card: available for use in 150+ countries

Foreign transaction fees: no fee to spend a currency you hold; currency conversion uses mid-market rate to plan limit, then fair usage fees apply – 1% out of hours conversion fee for all account tiers

International ATM withdrawals: some no-fee withdrawals every month, low fees after that

Westpac Foreign Currency Account

Westpac offers foreign currency accounts which are aimed at savers looking to earn interest on foreign currency balances. You can send and receive foreign currency payments, although fees may apply here. Saving in a foreign currency may appeal to people looking to diversify their portfolio, or planning to move overseas in future.

Because there’s no card offered with this account it’s not really optimised for day to day use – better for investing and saving.

Westpac account is best for: Saving in a foreign currency in an interest earning account with no ongoing fees

Westpac travel card: Not available

Foreign transaction fees: No card transaction option – sending international payments costs from 5 NZD, plus any exchange rate markup

International ATM withdrawals: Not available

ANZ Foreign Currency Account

The ANZ foreign currency account is available in 9 major foreign currencies, with minimum balance requirements and no ongoing fees to pay. ANZ highlights that this account is not suitable as a travel account as there is no card to use to make withdrawals – instead it is intended for people who need to make frequent overseas payments and would prefer to hold a balance in the foreign currency they need to send – for example, New Zealand residents with children studying abroad, or new arrivals to New Zealand sending frequent payments home.

ANZ account is best for: holding a foreign currency so you can make quick overseas payments when you need to

ANZ travel card: Not available

Foreign transaction fees: No card transaction option – sending international payments costs from 5 NZD, plus any exchange rate markup

International ATM withdrawals: Not available

BNZ Foreign Currency Account

BNZ foreign currency accounts are available in a good selection of foreign currencies. There’s no card with this account and you’ll pay a monthly fee if you don’t hold a fairly high balance – for example, if you’re saving AUD you’ll need to hold a balance of at least 125,000 AUD to avoid a 13 AUD monthly charge. Interest is available, but again you’ll need to hold above a fixed amount which is set by currency to earn this – the more you have in your account, the better the potential interest payment is.

This account is not intended to be a travel account, and is not suited to managing your money day to day.

BNZ account is best for: holding high value amounts in foreign currencies – this helps avoid monthly fees and unlocks interest earning

BNZ travel card: Not available

Foreign transaction fees: No card transaction option – no fee for sending international payments in a foreign currency

International ATM withdrawals: Not available

What are the advantages of international banks?

International banks can be extremely helpful for travellers, expats and digital nomads. There are different account types to suit varied customer needs, depending on whether you need to spend and withdraw, save and invest, or send and receive payments. Here are a few advantages of international banks for anyone living an international lifestyle:

- Hold and one or more foreign currencies all a convenient account

- Receive foreign currencies transfers

- Spend and withdraw internationally with a debit card

- Send transfers overseas to cover ongoing bills or remit money home

- Earn interest on foreign currency balances

How to choose the best international bank account for your needs

With so many different options available, picking the best international bank account for your needs will require a bit of thought. Here are some points to consider:

- Availability of Foreign Currencies: if you regularly need to send or receive a particular currency make sure it’s supported by your chosen account

- International fees: fees for sending payments abroad, or for spending with a debit card, can vary – check your account’s fee structure for the transactions you’ll make frequently

- Currency conversion rates: try to find an account which uses the mid-market exchange rate or as close as possible to it to keep costs down

- Safety: check the service you’re looking at is offered by a reputable and regulated provider

- International travel cards: if you travel or shop online with overseas retailers, having a card linked to your international account can make it more convenient – and sometimes cheaper – to spend in foreign currencies

How to open an international account

The account opening process varies by provider or bank, although you might be able to get everything done online if you’re opening an international account with a bank you already use, or with a digital first service like Wise or Revolut.

For security and to comply with law, you’ll always need to get verified at some point in the process, by either showing some paperwork in a bank branch, or by uploading images of documents, including:

- Proof of ID like a driver’s licence, Medicare card, passport or birth certificate.

- Proof of address, like a utility bill in your name

How to open international bank account online

Some New Zealand banks offer online options for account opening, but you may find you also need a local NZD account with the same bank. That might mean that you have to visit a branch or make a phone call to open both accounts at once.

With digital first providers like Wise and Revolut, the whole process takes place online including verification. As an example of how that works, here’s how to open a Wise New Zealand account online or in the Wise app:

- Download the Wise app or open the desktop site and tap Sign up

- Register with your email, Facebook, Apple or Google ID

- Follow the prompts to enter your personal and contact information

- Upload the required documents for verification

- Once your account is verified you can order a card and start to transact

Read more about what you need to open a bank account in New Zealang

What are the best international banks with no fees?

While many banks and other account providers offer accounts which don’t have an initial opening fee, you’ll usually find that there are still various charges to pay, such as maintenance, fall below, or transaction fees, depending on how you use your account.

Here’s a quick overview of the fee structure of the providers we’ve explored in this article. Bear in mind this is just the highlights – you’ll still need to review the account fee schedule for full detail:

Wise Account: No ongoing account fees, free to receive payments in many currencies, free to spend currencies in your account with your card

Revolut Account: Some accounts with no ongoing fees, no fee to spend currencies in your account with your card

Westpac Foreign Currency Account: No maintenance fee, transaction fees apply, including exchange rate markups

ANZ Foreign Currency Account: No maintenance fee, but minimum balance requirements and transaction fees apply, including exchange rate markups

BNZ Foreign Currency Account: Fees vary based on currency – for example, there’s a 13 AUD fee which is waived if you hold a balance of 125,000 AUD or more

What is the safest international bank?

All of the non-bank providers and New Zealand banks we’ve featured here are fully regulated and licensed with their own automatic and manual security measures in place.

Wise Account: Overseen by various regulatory bodies globally, with digital measures including instant transaction notifications, and ways to freeze, unfreeze or cancel your card in the app if you need to

Revolut Account: Registered and regulated, offering secure in-app transactions and ways to manage your card on the move

Westpac Foreign Currency Account: Registered and regulated New Zealand bank, with secure online and mobile banking options

ANZ Foreign Currency Account: Registered and regulated New Zealand bank, with secure online and mobile banking options

BNZ Foreign Currency Account: Registered and regulated New Zealand bank, with secure online and mobile banking options

Best ways to withdraw money when travelling abroad

Making contactless payments with your card or phone is the norm in many countries – but there are still times when only cash will do. In fact, depending on where you travel to, you might find that cash is more common than card use – making it essential that you know how to make low cost ATM withdrawals wherever you happen to be. Here are a few tips:

- Always check your banks currency conversion rates to see if there’s a markup or foreign transaction fee added

- See if you bank or card provider has particular international ATMs which can be used for low or no fees

- Always pay in the local currency for your withdrawal – if you’re asked if you’d prefer to pay in NZD it’s best to decline to avoid extra charges

- Get a multi-currency account to keep your money in local currencies and avoid paying high conversion fees with bad exchange rates

How to avoid foreign transaction fees

Foreign transaction fees are often added by banks and other providers when you spend with a card in a foreign currency. If you’re a frequent traveller, digital nomad or expat this can mean costs rack up quickly. Here are a few ways to avoid these costs:

- See if your bank has no foreign transaction fee card options – although credit cards may be the only choice here, which can mean extra costs

- If you’re shopping online, check if the retailer is based overseas – it’s not always obvious, and you’ll still be charged a foreign transaction fee if you’re shopping from home and paying in a foreign currency

- Choose a multi-currency account from a provider like Wise or Revolut which allows you to hold foreign currencies and pay with no foreign transaction fee

Read more on best no-fee bank accounts in New Zealand

Conclusion on best international bank for expats

New Zealand banks do offer foreign currency account options, but these are usually intended as a vehicle for saving or making overseas payments, for example if you have a child studying overseas, or if you’re paying a mortgage abroad. Non bank alternatives like Wise and Revolut can offer a more flexible solution if you want to be able to manage your money with a phone, spend with a card, and access mid-market rates when it’s time to switch from one currency to another.

Use this guide to decide which type of international account might suit you, based on your own unique needs and preferences.

FAQs on Best Banks for International Travel

Can you open an international bank account online?

You may not be able to open an international bank account online unless you’re choosing a bank you already have an account with. You can open an international account with a non-bank provider like Wise or Revolut online or in an app. You won’t get exactly the same options as you would with a bank – but you’ll be able to manage your money flexibly across currencies, with low fees.

What are the best international banks with no fees?

There are usually fees for some services – even if your international bank account is free to open. You might find monthly charges, minimum balance requirements or transfer costs for example. It’s worth comparing bank fee structures against alternatives like Wise and Revolut so you have an idea of the types of costs, and which might work best for you.

Which bank account is best for international travel?

There’s no single best bank for international travel. Picking an account with a linked card and easy ways to hold and spend foreign currencies is a good start, so you can access your money on the move – checkout Wise and Revolut as great non-bank providers with flexible, low cost international accounts.

How can you avoid bank charges when travelling internationally?

Check your account’s fees carefully before you head off, looking for foreign transaction fees and international ATM costs in particular. While you may not be able to avoid bank costs entirely, you can limit them by knowing in advance what different transaction types cost, and picking the right card for the job when you need to spend or withdraw.

What bank does not charge international ATM fees?

Generally, international accounts from New Zealand banks don’t come with a linked debit card. Instead, check out Wise and Revolut which both have debit cards which offer some no fee international ATM withdrawals, and great exchange rates.

Should you have a separate bank account for travel?

Having a separate international account is a smart way to manage your money across currencies. Having an account with a low cost payment card is also helpful as you’ll avoid foreign transaction fees and often get lower overall costs for your foreign currency spending.