Best no-fee bank accounts in New Zealand [2023]

All of New Zealand’s major banks offer a basic bank account which will often have no ongoing service fees. However, that doesn’t really mean they’re completely free. Most bank accounts will have some fees which you might run into depending on how you transact. They’re just normally wrapped up in some of the features available in the package, like the option to send, spend and withdraw money overseas, or access an overdraft.

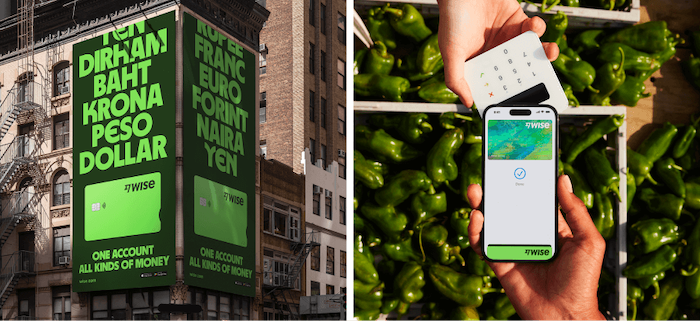

One alternative if you’re looking for an account which maintains a good range of features with the lowest possible fees, is to turn to a specialist provider like Wise or OFX. Fintech companies like these take modern approaches to the services they offer, and don’t have the overheads of a branch network. That can mean they drive down costs and offer better value overall. This guide covers all you need to know.

Fee free account options in New Zealand:

- Accounts from fintech companies

- Bank day to day transaction accounts

Best fee-free account offers in New Zealand

Completely fee free accounts don’t really exist. In most cases, when a bank or provider advertises a fee free account, they really mean ‘no monthly fees’. Other banks may offer accounts which have fees you can waive as long as you fulfil certain conditions – but again, that doesn’t really mean they’re free.

However, there are certainly still ways you can access accounts which will work out cheaper for you, by picking one with no monthly charges and no or low fees for the transactions you make often. To help, we’ve compared a few different options, looking at accounts from both fintech companies and banks, and analysing their products based on whether they have the following:

- Account opening fee

- Monthly charges

- Interest earning opportunity

- ATM withdrawal fees

- Foreign transaction fee

- International money transfer charges

- Account closure fee

We’ll also take a quick look at any other notable features for each bank and provider we review. Let’s dive in.

Fee-free accounts from fintech companies

Fintech companies aren’t banks, but they’re just as safe for the services they offer. That’s because they have to be licensed and regulated in much the same way as banks if they want to operate globally and in New Zealand, and as digital providers, they also tend to invest heavily in cutting edge technological approaches to account security.

Not all of the accounts on offer from fintech companies will have the same range of features as a bank. But some can compete on everyday money management tools, as well as having a better range of international functionality compared to regular basic bank accounts.

To give an example, we’ll look at Wise – which offers both personal and business accounts for New Zealand customers – and OFX, which offers business accounts with a particular focus on online sellers in New Zealand. Here’s how Wise and OFX measure up across our key fee areas:

| Provider/ service | Wise | OFX |

|---|---|---|

| Account opening fee | No fee | No fee |

| Monthly charges | No fee | No fee |

| Interest earning opportunity | Not applicable | Not applicable |

| ATM withdrawal fees | Up to 2 withdrawals, valued up to 350 NZD/month fee free

1.5 NZD + 1.75% fee after that |

No card available |

| Foreign transaction fee | Exchange currencies from 0.41%

Free to spend any currency you hold in your account |

Not applicable |

| International money transfer charges | From 0.41% | Free to send a payment over 10,000 NZD – a 15 NZD fee applies for lower value payments |

| Account closure fee | No fee | No fee |

| Other notable features | Accounts for personal and business customers

Hold and exchange 50+ currencies Local account details for 10 currencies |

Accounts for business customers only

Hold and exchange 7 currencies Get currency risk management services Get 24/7 phone support |

Pros and cons

Pros:

- Accounts available with no monthly fee and no minimum balance

- Multi-currency functionality and low cost international transactions

- Transparent pricing for services

- Good range of features covering many areas a traditional bank account would

Cons:

- Not all features you’d find from a bank – often you can’t access credit for example

- No branch network – all service is online, by phone, or chat

- No cash transactions available

Fee free bank transaction accounts

All of the large New Zealand banks offer some sort of basic bank account. While the names differ, these accounts typically come with no monthly fees, and a range of features including linked cards and the option to arrange an overdraft. Many everyday transactions are free – but there are still fees you’ll need to pay depending on how you need to use the account. Here’s a summary of the key features of basic bank accounts from some of New Zealand’s largest banks.

| Bank/service | Westpac Everyday Transaction Account | BNZ YouMoney | ANZ Go Account |

|---|---|---|---|

| Account opening fee | No fee | No fee | No fee |

| Monthly charges | No fee | No fee | No fee |

| Interest earning opportunity | Not interest earning | Not interest earning | Not interest earning |

| ATM withdrawal fees | Free to withdraw at a Westpac ATM

3 NZD to make an international withdrawal Fees may apply to order and maintain a debit card, based on the card you select |

No BNZ fee, although ATM operators may charge their own fees | No ANZ fee, although ATM operators may charge their own fees |

| Foreign transaction fee | 1.95% | 2.25% | 1.3% |

| International money transfer charges | 10 NZD – 30 NZD depending on how you arrange your transfer + currency exchange markups | 5 NZD – 25 NZD depending on how you arrange your transfer + currency exchange markups | 9 NZD – 28 NZD depending on how you arrange your transfer + currency exchange markups |

| Account closure fee | No fee | No fee | No fee |

| Other notable features | Optional overdraft

Earn Airpoints Dollars when you spend with your card |

Open up to 25 accounts to manage your money in separate pots

Optional overdraft |

Optional overdraft

No fee to get a linked debit card |

Pros and cons of bank checking accounts

Pros:

- Reliable, familiar banking brands

- No ongoing monthly fees to pay

- Branch support available if you’d prefer to transact face to face

- Full range of financial services including access to overdrafts

Cons:

- Transaction fees do still apply

- International payments, spending and withdrawal can be particularly costly

- Accounts can usually only hold, exchange and receive payments in NZD

To sum up: While truly fee free accounts are few and far between, you can definitely cut your money management costs by choosing an account which is free for the everyday services you use most.

If you prefer to keep tabs on your money via your phone, or if you regularly transact in foreign currencies, accounts from fintech specialists like OFX and Wise are likely to appeal. On the other hand if you’ll be spending and withdrawing in New Zealand only, and if you prefer a face to face service option, check out the basic bank accounts we’ve profiled above to see if one suits your needs better.

How to choose a fee-free bank account?

Nobody wants to pay more than absolutely necessary for ways to receive, spend and save their own hard earned money. However, operating a bank or fintech company comes with costs – which are ultimately passed on to consumers either in the form of ongoing account charges, or transaction fees. That means that finding a truly fee free bank account in New Zealand is pretty much impossible.

Instead, look for accounts which offer no monthly maintenance fee, no minimum balance or required monthly activity, and low transaction fees. In particular look at the costs for international transactions like sending and withdrawing foreign currencies, as these can be among the highest – and hardest to spot – costs charged by traditional banks.

Compare a few banks and modern alternative providers such as Wise or OFX to pick the one which best suits your individual needs.

Documents and eligibility

To open the accounts profiled above from traditional banks you’ll usually be able to use RealMe if you have it – or an in-app application process if you have New Zealand based ID documents like a passport or driving licence. If you don’t have these documents you’ll need to visit a branch to discuss your options and show the ID paperwork you hold.

Normally to open a fee free account from a regular bank you’ll need:

- Proof of identity

- Proof of address

- A New Zealand phone number

If you’re applying for an account from a specialist online service you may be able to use a foreign proof of ID to get your account set up.

When you might need a fee-free basic bank account

Fee free basic bank accounts are handy if you’re looking for ways to cut your banking costs, while still accessing most account features. They’re especially popular with people who don’t want to hold a fixed balance in their accounts – a common requirement for more ‘premium’ New Zealand bank accounts.

Basic bank accounts can also suit new arrivals in New Zealand, international students, people opening their first bank account – and more or less anyone who wants to pay less to spend their own money.

Options when we can’t get a fee-free with your bank

Traditional New Zealand banks will usually need you to provide a range of documents and a New Zealand proof of address to open an account – which can be hard if you’re new to the country or simply don’t have all the paperwork to hand. In this case it’s well worth checking out alternatives – like Wise and OFX. Depending on the provider you pick you may be able to open an account online or in-app, with your normal proof of ID and your proof of address, even if it’s outside of New Zealand.

Conclusion

While completely fee free bank accounts don’t really exist, it is possible to pay less to manage your money, by choosing a basic bank account from a traditional bank, or looking for an alternative account from a fintech company like Wise or OFX.

Traditional banks offer accounts with no ongoing fees, but do tend to wrap up charges into some of the features on offer, especially if you’ll be transacting in a foreign currency online or when you travel. Fintech accounts can offer a lot of the features a bank account does – but will often have lower transaction costs as they use modern approaches and technology to drive down the costs of offering financial services. Use this guide as a starting point to see which provider and account suits your needs best.

FAQ – Best No-Fee Bank Accounts in New Zealand

Which banks have no monthly fees?

All New Zealand’s major banks offer basic accounts which have no monthly charges to pay. However, they’ll usually have transaction costs which can still mount up quickly. Take a look at alternative providers like Wise and OFX for a new way to keep your costs down while still accessing flexible account services.

How to keep a day to day transaction account fee free?

To make sure you don’t pay fees for your regular account you’ll need to review the account terms and conditions carefully, and avoid transactions which come with costs. Common fees include out of network and international ATM withdrawals, sending and receiving international payments, and unauthorised overdraft costs.

Do day to day transaction accounts pay interest?

Some day to day transaction accounts from major New Zealand banks do pay interest. However, to benefit fully from this you may be required to make regular savings or upgrade your account to a fee paying product.