Best EUR account in New Zealand – 2026

Euros (EUR) are a major global currency making them popular for people who want to diversify their savings – plus, they’re the official currency in 20 countries, which means tourists, travellers and expats living in Europe need easy access to them too. Whether you’re planning your investments, or planning a trip of a lifetime to Europe, a euro account can be a convenient and cheap way to receive, hold, and spend euros without having to convert to and from NZD every time.

EUR accounts from New Zealand banks are aimed at savers and may have relatively high fees and high minimum balance requirements. They’re often also cumbersome, slow, and, most of all, expensive. Specialist providers like Wise or Revolut can be good alternatives if you want a flexible account to hold, spend and send euros.

In this article, we’ll walk through everything you need to know about opening a euro account, including the best EUR account options available, the costs, and how to open one.

Can a EUR account be opened in New Zealand?

Yes. New Zealand customers have a few different options when it comes to euro accounts. Major banks offer foreign currency accounts which can all be used to hold, send and receive euros. These accounts don’t come with debit cards, but often offer good interest on your EUR balance.

The alternative – which can be a more attractive option if you want an account for everyday use – is a non-bank provider. Companies like Wise or Revolut can have multi-currency accounts you can use to hold EUR alongside NZD and a broad selection of other currencies, and which also have cards you can use to spend and withdraw at home and abroad. We’ll dive into some more detail about your EUR account options later.

Read a full Wise account review here.

What are the advantages of a EUR account in New Zealand?

As we’ve seen, some people choose to open a EUR account to save and invest. Holding savings in a different currency can be handy if you’re planning to travel, but it’s also a good way to diversify your investment portfolio. Euro accounts are also handy for anyone who needs to send or receive payments in euros – you won’t need to convert your money back to NZD every time, which cuts down on unnecessary costs. Finally, some people want a EUR account to get a linked international debit card that can be used when travelling in the Eurozone. Providers like Wise and Revolut have payment cards optimised for overseas use, with great value currency exchange and some no-fee ATM withdrawals, too.

Businesses can also benefit from a EUR account if they need to pay and get paid in euros. You can hold a EUR balance as a hedge against exchange rate fluctuations, or for future payments, plus you can get paid in EUR by customers and clients, marketplaces and PSPs like Stripe.

Euro account details

If you need to get paid by others in euros, you’ll want to find a EUR account which has its own local euro bank details for receiving local payments. Some of the accounts we’ve looked at in this guide offer EUR account information including an IBAN and all you need to receive a payment in euros just like a local.

Best EUR accounts

We’ve picked out some good EUR accounts available in New Zealand, including foreign currency accounts from major banks and a couple of non-bank alternatives for comparison. We’ll start off with an overview, and then move into more detail about each in a moment.

| Provider | Availability | Fees | Debit card | Other features |

|---|---|---|---|---|

| Wise | Personal and business customers |

|

Yes |

|

| Revolut | Personal customers only |

|

Yes |

|

| Westpac Foreign Currency Account | Personal customers (other business account services are available) |

|

No |

|

| ASB Foreign Currency Account | Personal customers (other business account services are available) |

|

No |

|

| BNZ Foreign Currency Account | Personal customers (other business account services are available) |

|

No |

|

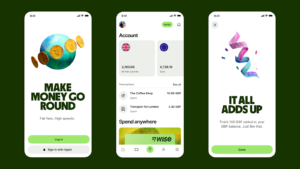

Wise

Open a Wise multi-currency account online or in the Wise app, to hold, send, spend and receive EUR. You’ll also be able to keep NZD and 40+ othercurrencies in your Wise account, making this a flexible option for people who travel a lot, or who shop online with international retailers. You’ll get local bank account details for 9 different currencies including NZD and EUR, to get paid by local transfers conveniently, plus there’s an international debit card for spending and withdrawals.

Currency conversion always uses the mid-market exchange rate with low, transparent fees from 0.43%.

Fees: No fee to open a personal account, 40 NZD one-off fee to open a business account. No monthly fee for either personal or business accounts

Currency conversion: Hold and convert 40+ currencies with the mid-market exchange rate

Other notable features: Receive payments with local bank details for 9 countries, send money to 160+ countries, spend with your linked debit card in 150+ countries.

Revolut

Revolut has 3 different account types, which all offer their own features and fees. You’ll be able to pick the account plan that meets your spending needs, to hold and exchange EUR alongside a broad selection of other currencies. All account tiers come with a linked debit card, although the type of card you get depends on the account plan you pick. You’ll also unlock some no fee ATM withdrawals, and some no fee currency conversion every month. No fee transaction limits vary by account tier.

Fees: Standard accounts have no monthly fee. Upgrade to a personal account with monthly charges for more features

Currency conversion: Broad selection of currencies available including EUR

Other notable features: Account services include budgeting tools, ways to split bills and easy person to person payment options

Westpac Foreign Currency Account

Westpac has a more traditional foreign currency account product which holds a single currency, and which does not come with a linked debit card. Foreign currency accounts are aimed more at people who want to save and invest in foreign currencies, in this case EUR. You can send and receive euro payments using your account, making them useful for paying bills in Europe, too.

Fees: No monthly fee, transfers into your account cost 15 NZD, telegraphic transfers out of your account cost from 5 NZD to 30 NZD depending on how you arrange them

Currency conversion: EUR and most major currencies supported, but you’ll need separate accounts to hold different currencies

Other notable features: No debit card; you’ll also need an eligible Westpac NZD account

ASB Foreign Currency Account

ASB’s EUR account is a foreign currency account product with no monthly fee to pay. As with most bank euro accounts, there’s no debit card, but you can send and receive euro transfers. You’ll need to deposit 5,000 EUR to open your account in the first place, and fees may apply when you send and receive payments using your ASB EUR account.

Fees: No monthly fee; 5,000 EUR minimum balance required

Currency conversion: EUR and most major currencies supported, but you’ll need separate accounts to hold different currencies

Other notable features: Not a travel account, intended for international transfers and saving only

BNZ Foreign Currency Account

The BZN foreign currency account has a 7.5 EUR a month fee, which is waived if your average balance over the month is at least 74,000 EUR. If your account balance is 10,000 EUR or more you may earn interest, with a variable tiered rate that changes based on the amount you hold in your account This account doesn’t come with a bank card, so it’s not suited to people looking to spend while they travel.

Fees: 7.5 EUR monthly fee, waived if you have a balance of 74,000 EUR; 10 NZD incoming payment fee

Currency conversion: EUR and most major currencies supported, but you’ll need separate accounts to hold different currencies

Other notable features: No linked debit card, account aimed at people who save or invest in EUR

How to open a EUR account in New Zealand

The process to open a EUR account will depend on the provider or bank you pick. Banks have online opening options, particularly if you already have a NZD account with the same institution, and have your online banking credentials to hand. If you’re not already a customer at the bank you might have to go to a branch to open both a NZD account and a EUR account at the same time.

Non-bank providers don’t have a branch network, so you can apply online or in an app, with a fully remote onboarding process.

Here are the basic steps you’ll need to take to open a EUR account in New Zealand.

- Choose the best provider for your needs

- Register for your account online, through the provider app, or in a branch

- Give your personal and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

The verification step is usually pretty straightforward. The bank or non-bank provider you pick will need to confirm your identity, and usually your address too. That’ll mean showing some paperwork in person if you’re at a bank branch, or uploading images of your documents if you’re applying online. You may also need to take a selfie to show that your image is the same as that on your ID document.

The exact documents you need will vary depending on the account type, but can include:

- Government issued photo ID

- Proof of address – a utility bill or bank statement in your name for example

- Tax ID information

- Business registration documents if you’re opening a business account

Euro account with debit card

As we’ve discussed, the foreign currency accounts offered by banks are usually more about ways to save and invest than easy options for spending. If you need a euro account for travel and for shopping online, you’ll need a debit card – not something the major banks offer with their EUR accounts. In that case, a specialist non-bank provider might be better. Here’s a reminder of the non-bank alternatives we introduced earlier:

Wise account and card: Order a card for a 14 NZD one time fee, and spend in 150+ countries, in 40+ currencies. EUR supported for holding and exchange, and all currency conversion uses mid-market rates with low fees

Revolut account and card: All Revolut account plans have a linked card which can be used for spending and withdrawals in the Eurozone and globally. The amount you’ll pay per transaction will depend on your account type – all account plans have some no fee currency conversion, but fair usage fees apply once you’ve exhausted your plan limit

Conclusion: EUR accounts in New Zealand

EUR accounts can be handy for both individuals and businesses, and offer easy ways to receive, hold, send and spend in euros. You could get better exchange rates when you use a foreign currency or multi-currency account compared to a NZD account, and you’ll often save on costs overall, with no foreign transaction fees and some fee free ATM withdrawals, too.

Whether a EUR account from a bank or a specialist service suits you will depend on what you want to do. For saving and investing, the EUR accounts from New Zealand banks are a good fit. However, if you need a linked international debit card and a flexible low cost account, the chances are that you’ll prefer online non-bank providers instead. They’re just as safe, and often cheaper and easier to use than a bank, too. Use this guide to kickstart your research and find your perfect match.

FAQs – EUR Accounts in New Zealand

Can I open a EUR account in New Zealand?

Yes. You can open a EUR account as a foreign currency account from a major bank, or you can pick an account from a specialist non-bank alternative like Wise or Revolut.

How much does it cost to open a EUR account?

Online specialist accounts often have no opening fee, and may also have no monthly fee to pay. EUR accounts from banks vary – some have monthly fees unless you maintain a high balance, while others offer accounts with no maintenance costs. You’ll still need to hold a NZD account with the same bank, though, which may have its own monthly costs to consider.