Best AUD account in New Zealand in 2026

An Australian dollar (AUD) account lets you hold, send and receive payments in AUD without needing to convert to and from NZD unnecessarily. If you travel to Australia often you may want an account you can use to spend with a linked payment card conveniently. Or, if you’ve got bills to pay in Australia, or you need to get paid in AUD from others, you might want an account you can use to make and receive cross border payments cheaply.

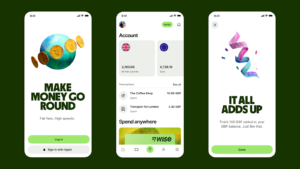

AUD accounts from New Zealand banks can be cumbersome, slow, and, most of all, expensive. The good news is that there are other options. Specialist providers like Wise or Revolut can be good alternatives if you want a flexible account to hold, spend and send Australian dollars.

In this article, we’ll walk through everything you need to know about opening an Australian dollar account, including the best AUD account options available, the costs, and how to open one.

Quick summary: AUD currency account

- Wise Australian dollar account: Hold and exchange 40+ currencies including NZD and AUD, with a debit card and no ongoing fees

- Revolut Australian dollar account: 3 different account plans which all support AUD and 4 other currencies, some no fee currency conversion with the Revolut rate

- Westpac Australian dollar account: AUD account to hold, send and receive payments, and earn interest on your AUD balance

- ASB Australian dollar account: AUD account with no debit card, intended for saving or investing mainly – 5,000 AUD minimum balance required

- BNZ Australian dollar account: AUD account with a monthly fee, waived if you have a balance of 125,000 AUD

Can an AUD account be opened in New Zealand?

Yes. If you live in New Zealand but need to transact in AUD regularly, there are a few different account options out there.

If you only need to send and receive payments, or if you’re looking to hold a balance in AUD in an interest earning account, a foreign currency account from a bank may suit your needs. These accounts are safe and familiar, but can often have pretty high minimum balance requirements and fees.

If you want to be able to spend in AUD with a debit card, you’ll need a specialist non-bank solution. We’ve got more on two you might consider – Wise and Revolut – later.

Read a full Wise account review here.

Best AUD accounts

We’ve picked out some good AUD accounts available in New Zealand, including foreign currency accounts from major banks and a couple of non-bank alternatives for comparison. We’ll start off with an overview, and then move into more detail about each in a moment.

| Provider | Availability | Fees | Debit card | Other features |

| Wise | Personal and business customers |

|

Yes |

|

| Revolut | Personal customers only |

|

Yes |

|

| Westpac Foreign Currency Account | Personal customers (other business account services are available) |

|

No |

|

| ASB Foreign Currency Account | Personal customers |

|

No |

|

| BNZ Foreign Currency Account | Personal customers (other business account services are available) |

|

No |

|

Information correct at the time of the writing – 29.08.2024

Wise

Both individual and business customers can choose a Wise multi-currency account to hold 40+ currencies including both AUD and NZD. You’ll get local account details for 8+ different currencies and an Australian account number and BSB, to get paid by local transfers conveniently, as well as other options to get paid by SWIFT transfer in select currencies.

There’s an international debit card for spending and withdrawals with some free monthly ATM use before fees begin. Accounts are opened and managed online or in the Wise app, so your Wise account and card can travel with you wherever you’re headed.

- Fees: No fee to open a personal account, 40 NZD one-off fee to open a business account. No monthly fee for either personal or business accounts

- Supported currencies: Hold and convert 40+ currencies with the mid-market exchange rate

- Wise exchange rates: Mid-market rate with fees from 0.33%

- Receiving payments: Local account details for 8+ currencies, options to get paid by SWIFT transfer in select currencies

- Other notable features: Send money to 160+ countries, spend with your linked debit card in 150+ countries.

Revolut

Revolut has 3 different account tiers so you can pick the features and fees that work best for your specific needs. Standard accounts have no monthly fee, or you can upgrade for 9.99 NZD or 19.99 NZD a month, depending on the features you need and how often you want to transact.

All accounts have a linked debit card, and let you hold and exchange AUD as well as a selection of 4 other currencies. Depending on the account tier you select, you’ll get some no fee ATM withdrawals, and some weekday currency conversion every month which uses the Revolut exchange rate with no extra fee. No fee transaction limits vary by account tier.

- Fees: Standard accounts have no monthly fee. Upgrade to a personal account with monthly charges of up to 19.99 NZD for more features

- Supported currencies: 5+ currencies available including AUD

- Revolut exchange rates: Revolut exchange rate to plan limits – out of hours and fair usage fees may apply

- Receiving payments: Receive in NZD only

- Other notable features: Account services include budgeting tools, ways to split bills and easy person to person payment options

Westpac Foreign Currency Account

Westpac offers a foreign currency account which you can open to hold AUD. This is a single currency account, so you won’t be able to add a balance in another currency to the same account. However, you can use your AUD account to hold, send and receive payments, and earn interest on your AUD balance. Because there’s no linked debit card this isn’t an account intended for travel, but could suit people paying bills in Australia, or saving in AUD.

- Fees: No monthly fee, transfers into your account cost 15 NZD, telegraphic transfers out of your account cost from 5 NZD to 30 NZD depending on how you arrange them

- Currency conversion: AUD and most major currencies supported, but you’ll need separate accounts to hold different currencies

- Other notable features: No debit card; you’ll also need an eligible Westpac NZD account

ASB Foreign Currency Account

The ASB AUD account has no monthly fee to pay, but you’ll also have to have an ASB transaction or savings account, which might have its own maintenance fees. ASB AUD accounts aren’t intended as travel accounts. There’s no debit card, so you can’t get your AUD in cash while you’re away, so this account is more about saving and making electronic bank transfers in AUD. You’ll need to have a minimum deposit amount to start you off, of 5,000 AUD.

- Fees: No monthly fee; 5,000 AUD minimum balance required

- Currency conversion: AUD and most major currencies supported, but you’ll need separate accounts to hold different currencies

- Other notable features: Not a travel account, intended for international transfers and saving only

BNZ Foreign Currency Account

The BZN Australian dollar account has a 13 AUD monthly fee, waived if your average balance is at least 125,000 AUD. You can also earn interest on your balance as long as it is 10,000 AUD or more. This account doesn’t come with a card for spending or withdrawals, so it’s not suited to people looking to spend while they travel.

Fees: 13 AUD monthly fee, waived if you have a balance of 124,000 AUD; 10 NZD incoming payment fee

Currency conversion: AUD and most major currencies supported, but you’ll need separate accounts to hold different currencies

Other notable features: No linked debit card, account aimed at people who save or invest in AUD

What is an AUD account?

With an Australian dollar account you can hold an AUD balance to send payments to others, save or invest. The most flexible AUD accounts also support other currencies as well as AUD, and come with debit cards for spending and withdrawals. Different accounts have their own features and fees, so comparing a few is the best way to find the right one for your needs.

How to open an AUD account in New Zealand

How to open your AUD account will depend somewhat on the bank or provider you pick. As the banks we’ve featured here all need you to also have an eligible transaction or saving account, you’ll need to get that set up first. That may mean you need to visit a branch to get verified before you can start opening your AUD account.

Non-bank providers don’t have a branch network, so you can apply online or in an app, with a fully remote onboarding process.

Here are the basic steps you’ll need to take to open an AUD account in New Zealand.

- Choose the best provider for your needs

- Register for your account online, through the provider app, or in a branch

- Give your personal and contact information

- Complete the required verification steps

- Fund your account – and you’re ready to go

All financial service providers are legally bound to verify customers, checking on their ID and usually their address. That means you’ll need to either present some paperwork in person if you’re at a branch, or you’ll have to take a photo of your documents and upload it to your preferred provider’s app.

The exact documents you need will vary depending on the account type, but can include:

- Government issued photo ID

- Proof of address – a utility bill or bank statement in your name for example

- Tax ID information

- Business registration documents if you’re opening a business account

What are the advantages of an AUD account in New Zealand?

Individuals can use an AUD account with a debit card to spend and make withdrawals in Australia, and to get lower overall costs when shopping online at Australian stores. Some bank AUD accounts also offer interest on your balance, which can be attractive if you’re looking to grow and diversify your investments.

Businesses can open AUD accounts too. That’s handy if you have customers or suppliers in Australia and need to pay and get paid in Australian dollars. You can hold an AUD balance as a hedge against exchange rate fluctuations, or for future payments, plus you can get paid in AUD by customers and clients, marketplaces and PSPs like Stripe.

Australian dollar account details

If you’re thinking of getting an AUD account so you can get paid by others, you’ll need to make sure your account comes with a local Australian BSB and account number. This will allow people in Australia to send you payments using local payment methods – often cheaper, faster and more easily than using a telegraphic transfer. Some providers we’ve featured, like Wise, offer AUD account details as well as NZD details, and local bank details from a selection of other countries too.

Best AUD accounts

We’ve picked out some good AUD accounts available in New Zealand, including foreign currency accounts from major banks and a couple of non-bank alternatives for comparison. We’ll start off with an overview, and then move into more detail about each in a moment.

Australian dollar account with debit card

New Zealand banks have targeted their AUD accounts at savers and people who need to make payments to Australia electronically. That means their accounts don’t have a debit card and you can’t get access to your money while you’re abroad. If you want an AUD account for travel, you’ll need a different type of account. Here’s a reminder of the non-bank alternatives we introduced earlier:

Wise account and card: Order a card for a 14 NZD one time fee, and spend in 150+ countries, in 40+ currencies. AUD supported for holding and exchange, and all currency conversion uses mid-market rates with low fees

Revolut account and card: All Revolut account plans have a linked card which can be used for spending and withdrawals in Australia and globally. The amount you’ll pay per transaction will depend on your account type – all account plans have some no fee currency conversion, but fair usage fees apply once you’ve exhausted your plan limit

Conclusion: AUD accounts in New Zealand

AUD accounts are handy for lots of people, from spending on a trip to Australia, to shopping online, saving, investing and sending payments. Different AUD account types are focused on different customer needs. While that means you’ll need to shop around a bit to find the right one for you, it does have the upside that there will almost certainly be an account out there that’s a good fit.

AUD accounts from New Zealand banks are optimised for saving and investing, with ways to send and receive AUD transfers. However, they don’t come with a debit card and so aren’t suited to travel use. If you want a flexible low cost account for travel, check out non-bank providers instead. They’re just as safe, and often cheaper and easier to use than a bank, too. Use this guide to kickstart your research and find your perfect match.

FAQs – AUD Accounts in New Zealand

Can I open an AUD account in New Zealand?

Yes. You can open an AUD account as a foreign currency account from a major bank, or you can pick an account from a specialist non-bank alternative like Wise or Revolut.

How much does it cost to open an AUD account?

Online specialist accounts often have no opening fee, and may also have no monthly fee to pay. AUD accounts from banks vary – some have monthly fees unless you maintain a high balance, while others offer accounts with no maintenance costs. You’ll still need to hold a NZD account with the same bank, though, which may have its own monthly costs to consider.