Is CashApp available in New Zealand? Review and alternatives

CashApp offers easy ways to send payments using just a phone number or $Cashtag, so you can get money to friends, family, businesses and organizations without needing to get hold of the recipient’s full banking details. However, CashApp is not available to users in New Zealand. You can only get CashApp in the US or the UK.

So – there’s no CashApp NZ, but the good news is that you have options. This guide explores popular alternatives, including Wise, OFX, TorFX, WorldRemit and Remitly, so you can find the right service for your payment, based on fees, rates, convenience and speed.

As alternatives, we’ll explore:

- Wise – fast payments to 140+ countries in 40+ currencies

- OFX – international transfers you can arrange online, in app and by phone

- TorFX – great customer service record, with transfers in 40+ currencies

- WorldRemit – good for cash collection payments

- Remitly – popular provider with an excellent range of pay out options

What can you do with CashApp?

If your question was does New Zealand use CashApp, the answer is no. However, there are different providers which can help you, depending on the specific CashApp services you were interested in.

Before we look at some CashApp NZ alternatives, let’s look at some of CashApp’s key features. We’ve picked out alternative providers which can offer similar services – which have a presence in New Zealand:

- Send instant payments to other CashApp users

- Make ATM withdrawals and in person payments with your linked debit card

- Receive direct deposit to your account up to 2 days early

- Invest in stocks from as little as 1 dollar

- Buy and trade virtual currencies like bitcoin

Does CashApp work in New Zealand?

No. CashApp accounts can only be opened and used for payments in the US and in the UK. You’ll need to have a local phone number in one of these countries when you register your account – and international transfers can only be made between CashApp accounts based in either the UK or the US.

Can you send money internationally with CashApp?

CashApp can only be used for international transfers to other CashApp accounts in the UK. No other countries are supported by CashApp at the time of writing – so no other international payments are available.

Comparing CashApp Alternatives

CashApp is not an option for you from New Zealand. Instead, you’ll need to pick an alternative online or digital provider to hold, send and spend your money.

To find the best CashApp alternative for your specific needs let’s compare Wise, OFX, TorFX, WorldRemit, and Remitly.

We’ll review based on each provider’s account and payment options, speed, transparency, ease of use and price. There’s more detail coming up later to help you decide which might suit your specific needs best.

| Wise | OFX | TorFX | WorldRemit | Remitly | |

|---|---|---|---|---|---|

| Transfer options | Send to bank accounts and mobile money accounts | Send to bank accounts | Send to bank accounts | Send to various pay out options including banks and cash | Send to various pay out options including banks and cash |

| Account and card | Multi-currency account and debit cards available | No holding account or card | No holding account or card | No holding account or card | No holding account or card |

| Exchange Rates | Mid-market exchange rate | Exchange rates include a small markup | Exchange rates include a small markup | Exchange rates include a small markup | Exchange rates include a small markup |

| Countries or currencies you can send money to | 140+ countries, 40+ currencies | 170 countries, 50+ currencies | 40 currencies | 130+ countries | 170 countries |

| Transfer fees | Low fees from 0.23% | No transfer fee over 10,000 NZD

12 NZD for smaller transfers |

No transfer fee | Variable fee depending on payment type | Variable fee depending on payment type |

| Receive payments to your account | Receive in major foreign currencies and NZD | No holding account offered | No holding account offered | No holding account offered | No holding account offered |

*Details correct at time of writing – 3rd May 2025

There’s no single best CashApp alternative for New Zealand. The right one for you may vary based on what you need, where you’re sending money to and how you want it to be collected.

If you want a CashApp alternative for ways to receive and hold payments Wise is one to look at.

Wise is also a strong pick if you’re sending a payment directly to a bank account, as you’ll get the mid-market rate. On the other hand, if you need to get money quickly to someone without access to a bank account, WorldRemit or Remitly may be best for you, with a strong agent network which can make it easy to set up a cash collection payment.

Keep reading to learn more about each of our CashApp alternatives.

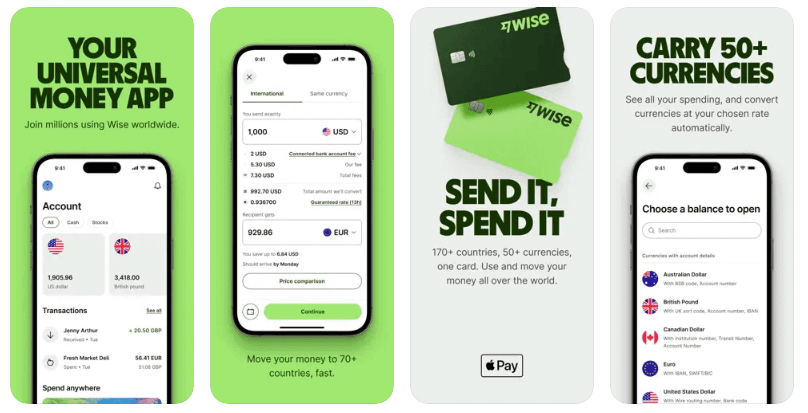

Wise

If you’re looking for an account to hold and receive payments, or need to make fast overseas payments to a bank account, Wise might be the CashApp alternative for you. Wise offers transfers to 140+ countries, in 50+ currencies, for individuals and businesses around the world. All currency conversion uses the mid-market exchange rate, with low, transparent fees you can check and compare before you confirm your transfer.

- Open your account online or in the Wise app, and have transfers delivered direct to bank accounts for convenience

- Multi-currency accounts available to hold and exchange 40+ currencies, with linked payment cards

- Receive payments in foreign currency and NZD to your Wise account, often with no fee

- Low cost transfers which use the mid-market exchange rate

Pros and Cons of Using Wise

| Wise pros | Wise cons |

|---|---|

| ✅ Account, card and payment services ✅ No exchange rate markups ✅ Costs are visible before you make your payment, so you can compare fees ✅ Receive foreign currency payments |

❌ No cash pay out option ❌ Fees vary by destination ❌ No branch network |

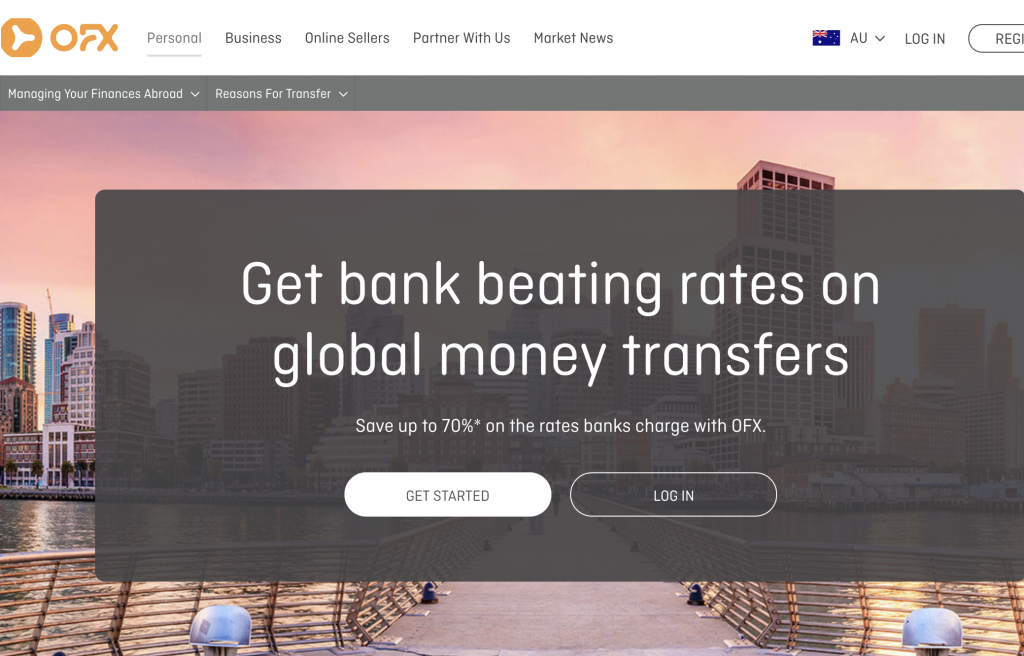

OFX

If you need to send a larger value payment, and prefer to talk through your options over the phone, OFX might be the answer for you. Send money in 50+ currencies, online, in-app or by phone, with no transfer fee for high value payments. Instead you just pay a low currency exchange markup. OFX also offers currency risk management solutions for individual and business customers which can reduce your exposure to fluctuations in the FX markets.

- Personal phone service through a currency exchange broker, 24/7

- Currency risk management products available, as well as one off and recurring transfers

- High value payments available, in 50+ currencies

- No transfer fee for high value transactions – just a small exchange rate markup

Pros and Cons of Using OFX

| OFX pros | OFX cons |

|---|---|

| ✅ Talk through your transaction with a broker ✅ Broad range of countries and currencies supported ✅ Personal and business services available ✅ Currency risk management solutions |

❌ 12 NZD fee on payments under 10,000 NZD in value ❌ Variable exchange rate markups apply ❌ Payments may take a day or two to arrive, depending on destination |

TorFX

TorFX has an excellent reputation for customer service which is available by phone, online and in app. You can send payments in 40+ currencies, with no transfer fee. Instead there’s an exchange rate markup, which is included in the rate you’re quoted when you set up a transfer. Payments can usually arrive in a day or so, and are deposited to the recipient’s bank account.

- Known for great customer service by phone, online and in app

- Currency risk management products available, as well as one off and recurring transfers

- Secure and trusted provider with an excellent credit rating

- No transfer fee, although a small exchange rate markup applies

Pros and Cons of Using TorFX

| TorFX pros | TorFX cons |

|---|---|

| ✅ No transfer fee ✅ Broad range of countries and currencies supported ✅ Known for great customer service ✅ Currency risk management solutions |

❌No holding account or card ❌ Variable exchange rate markups apply ❌ No cash pay in or pay out options |

WorldRemit

WorldRemit is a popular payment service which lets you set up your transfer online or via the WorldRemit app, and have it delivered to a bank or mobile money account, for collection in cash in the destination country, or even as an airtime top up. If you’re sending money to someone who doesn’t have easy access to a bank account or ATM, WorldRemit can be a solid option, with transfers to 130+ countries, often with fast delivery times.

- Pay for your transfer by card, and it can often be collected in cash pretty much instantly

- Impressive coverage, offering transfers to 130+ countries

- Pay by bank deposit, credit or debit card

- Easy online and in-app payment options, with a good range of payout options

Pros and Cons of Using WorldRemit

| WorldRemit pros | WorldRemit cons |

|---|---|

| ✅ Good for payments on popular remittance routes, with cash collection available ✅ Transfers are usually fast and often instant ✅ Relatively low fees and frequent promotional offers for new customers ✅ Arrange your transfer online or in app |

❌ Service availability varies by destination ❌ Exchange rate markups may apply, which push up overall costs ❌ Credit card payments can incur additional fees |

Remitly

Remitly supports payments to 170+ countries from New Zealand and has a great range of pay out methods. You can set up your transfer for cash collection or home delivery, or have the money deposited to a bank or mobile money account. This gives flexibility if you’re sending to someone who doesn’t have easy access to an ATM or their bank.

- Pay someone for cash collection, home delivery, or to a bank or mobile money account

- Variable fees and exchange costs, with different transfer speed options in some countries

- Payments supported in a range of currencies

- Easy to open an account and make a transfer with your phone

Pros and Cons of Using Remitly

| Remitly pros | Remitly cons |

|---|---|

| ✅ Easy, fast payments ✅ Send to an excellent range of countries ✅ Cash pay out options can be good for customers without access to a bank ✅ Intuitive app and online payment process |

❌ Not all services are offered in all countries ❌ Rates include an exchange rate markup ❌ Variable fees apply |

Conclusion

CashApp is very handy for people in the US or the UK. However, if you’re based in New Zealand you’ll need another solution.

Many online and in-app providers offer accounts, debit cards, and fast, secure and convenient international payments in a broad range of countries – with services that can be every bit as intuitive and easy to use as CashApp. You might even find you can save money if you shop around and find the best provider for your needs.

The right CashApp alternative for you will depend on your specific needs – Wise could be a hit if you want a multi-currency account and card, with ways to send a low cost payment to a bank account, while WorldRemit may be a winner for transfers to be collected in cash, for example. Use this guide to kickstart your research and make sure you get the best deal out there.

CashApp International Transfer FAQs

Can you use CashApp in New Zealand?

No. To set up a CashApp account you’ll need to be in the US or UK, with a local phone number. The service isn’t available to residents in other countries.

Can you CashApp someone in another country?

CashApp supports payments to other CashApp accounts in the US or UK. No other international services are available – instead, look at alternatives like Wise, OFX and WorldRemit to make your overseas payments.

Does CashApp convert currency?

CashApp can only be used to convert from US dollars to British pounds, or vice versa. Other currencies are not supported.