International Virtual Cards: What are the Best Options? 2026

Considering getting a virtual debit to allow you to make simple payments online and using just your phone? There are several options for virtual card services for New Zealand customers, across both debit and credit cards, which means you’ve got a choice to make. This guide walks through all you need to know about virtual debit and credit cards, why they’re used and how to get one. Let’s dive right in.

International virtual cards: The best options

Let’s take a look at some of the main providers of virtual debit and credit cards here in New Zealand. We’ve featured digital providers Wise and Revolut, alongside ASB in case you want a virtual card from a major bank, so you can compare and decide which might suit you best.

Best international virtual cards:

| Provider | Card type | Wait time | Card fee | AER | Benefits |

|---|---|---|---|---|---|

| Wise virtual card | Debit card | Instant once physical card is ordered | 14 NZD to order the physical card | Not applicable | Hold and exchange 40+ currencies, spend globally online and in person |

| Revolut virtual card | Debit card | Once account is verified | No fee to get a Standard account and card | Not applicable | Hold and exchange multiple currencies, split payments with friends, spend in 150+ countries |

| ASB virtual card | Debit and Credit cards | Once account is verified | Varies based on the physical card you hold – credit cards are up to 80 NZD a year | Varies based on the physical card you hold | You’ll be able to continue earning any cashback or rewards as you spend with your mobile |

ASB virtual cards are not offered with multi-currency accounts. While they can be used for spending and withdrawals overseas, you won’t be able to hold a foreign currency balance, which can mean you pay a foreign transaction fee when you transact. If you’re looking for a flexible virtual card and don’t need a card from a bank with a physical branch network, switching over to a digital non-bank provider like Wise or Revolut can mean lower overall costs and a better exchange rate when you transact internationally. We’ll dive into the options in more detail later.

Best international virtual cards: A comparison

While banks like ASB do offer the option to get a virtual card with any debit or credit card they issue, there are also some great non-bank alternatives which can offer more flexible cards with lower overall costs. These cost benefits come into their own when spending internationally, as you’ll often get a great exchange rate with no foreign transaction fee. Let’s look at how non-bank specialists Wise and Revolut measure up against major bank ASB.

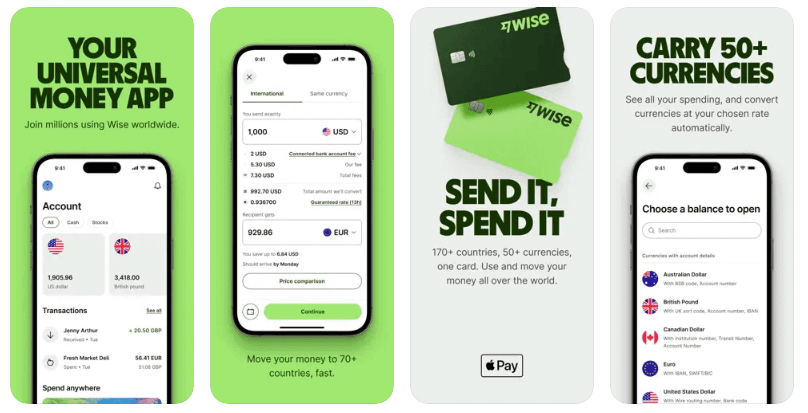

Wise

Open a Wise account online or in the Wise app, and get an instant virtual card you can use to spend in 150+ countries. Wise accounts can hold 40+ currencies, and there’s no fee to spend any currency you hold in your account. If you need to switch from dollars to another currency for spending, your card can do this automatically, with low fees from 0.43%. You have to order a physical Wise card to get a virtual Wise card, which means you have to pay the one time fee of 14 NZD for the physical card. As soon as your physical card order is processed you can spend on your virtual card, so there’s no need to wait – and you’ll always have your physical card too for those times when you need to withdraw cash.

Read a full Wise card review here

Pros

- No cost to open an account, no monthly fee to pay

- Hold and exchange multiple currencies with the mid-market rate and spend any currency you hold for free

- Debit card, so no credit check and no interest to pay

Cons

- You have to order a physical card and pay a 14 NZD card order fee to get a virtual card

- Currency conversion fees from 0.43% apply

Revolut

Revolut has recently launched in New Zealand and offers a personal Standard account with a linked multi-currency account, physical and virtual cards. You’ll be able to generate a standard virtual card and also one time use disposable virtual cards for no fee once you have a verified account with Revolut. Hold a selection of currencies and spend in 150+ countries conveniently with either your physical or virtual card. Standard plan customers can convert up to 2,000 NZD a month with no fee, and then a fair usage charge of 0.5% kicks in.

Read a full Revolut card review here

Pros

- Standard accounts have no monthly fee to pay

- Virtual cards can be generated with no fee

- Hold and exchange multiple currencies

Cons

- Fair usage fees of 0.5% can apply

- Out of hours currency conversion costs more

ASB

ASB virtual credit and debit cards can be generated in the ASB mobile banking app and will then sit in your account as a separate card option linked to the same base account. There’s a broad choice of account and card types, including everyday accounts which have debit cards and no monthly fee, and credit cards which have higher fees but can come with rewards when you spend. That means it’s easy enough to find the account type you prefer and then add on a virtual card as an extra service once your account is open.

Pros

- Virtual cards can be generated for any debit or credit card

- Create a virtual card by logging into mobile banking

- Major bank with a branch network if you need help

Cons

- Foreign transaction fees apply to all overseas spending

- Annual or monthly fees may apply to the underlying account or card

Types of international virtual cards

A virtual debit or credit card works like your regular physical card, but instead of being a piece of plastic, it’s available through your phone or smart device.

That has the advantage that you won’t need to carry a physical card around with you, but also the drawback that you can’t usually use a virtual card where a physical payment is required – so when you make an ATM withdrawal for example. Virtual cards come in handy for any contactless payments though – just tap your phone to pay instead of your physical card.

Virtual credit cards

A virtual credit card works like a physical credit card – which means you’ll need to apply and get approved for a card based on a credit check. Usually you’ll also be issued a physical card at the same time, but a virtual credit card is handy because it may be instantly available once your account application is approved, whereas a physical card could take a few days to arrive.

Virtual credit cards don’t have the same card numbers as your physical credit card, but they still link back to the same payment account. That means at the end of the month you’ll get a bill including the spending from your physical and virtual cards all together and you’ll need to settle it to avoid interest fees.

Virtual debit cards

Virtual debit cards can often be instantly generated once you’ve got a verified account with a bank or provider. There’s not usually any credit check and in most cases then just add your virtual card to a wallet app like Apple Pay or Google Pay for easy spending.

Usually getting a virtual card is a free service. Your virtual card won’t have the same card number as any physical card you hold, which can add a layer of security too. If you’re spending online with a new merchant, for example, you can often generate a virtual card, use it to pay, and then cancel it immediately, so you’ll know the details can’t be used again fraudulently.

How do international virtual cards work?

Virtual cards are just like physical cards but in a digital format. Once you have your virtual card you can use it to pay online, transfer money, or link it to a wallet like Apple Pay or Google Pay. By adding your card to a wallet app you can make contactless payments in physical stores by holding your phone to the card reader.

How to request an international virtual card

The exact process to get your virtual card might vary depending on the provider. If you’re choosing a virtual card from a major bank you’ll need to have an account set up and verified, and get online banking services activated to get your virtual card. This might mean a visit to a branch.

Digital providers like Wise have online onboarding processes for convenience. As an example, here’s how to request a virtual debit card with Wise:

- Open a Wise account online or in the Wise app

- Complete the verification step by uploading your documents

- Log into your account in the Wise app and open a currency balance of your choice

- Go to the Cards tab and tap the option to order a card

- Verify your personal details

- Pay the 14 NZD fee to order your card

- Your Wise virtual card will be available instantly in the Wise app

How to use an international virtual card

Once you have a virtual debit or credit card set up you can use it to make purchases online or to add to a wallet for mobile payments. You can link your card to a wallet like Google Pay or Apple Pay easily – either by opening the provider’s app and tapping the option to add to a wallet, or by opening the wallet you prefer and linking from there.

Some banks and providers also offer temporary cards. These are virtual single-use cards to shop at any prepaid card-accepting online stores, and can be handy when you’re shopping with a new retailer and want to protect your regular card details as much as possible.

Read also 3 best prepaid travel cards for New Zealanders

What are the transaction fees applied to an international virtual card?

Virtual cards can be used to spend more or less anywhere that contactless payments and the card’s network is supported, globally. However, it’s important to note that foreign transaction fees or exchange rate markups might be applied when you spend in a foreign currency with your virtual card. That can push up the costs overall.

To build a picture let’s look at the foreign transaction fees applied by the cards we’ve profiled above.

| Provider | Foreign transaction fees |

|---|---|

| Wise | No fee to spend currencies in your account, currency conversion from 0.43% |

| Revolut | No fee to spend currencies in your account, Standard account holders get up to 2,000 NZD a month with no-fee currency conversion, fees of 0.5% apply after that |

| ASB | 1.10% – 2.10% depending on the card you pick |

Here’s a roundup of the fees you need to know about for these providers:

- Wise: 14 NZD fee to get a physical card, no additional fee to get a virtual card, no foreign transaction fee and currency conversion from 0.43%

- Revolut: No fee to open an account or get a virtual card, no foreign transaction fee, 0.5% fair usage fee after you exhaust account currency conversion limits

- ASB: Card fees vary up to to 80 NZD annually, foreign transaction fees up to 2.10%

Advantages and disadvantages of the international virtual card

International virtual cards offer some advantages and disadvantages compared to relying on physical debit or credit cards. Depending on your needs and priorities, virtual cards can be a very good alternative to physical cards. Here’s what you need to think about:

Advantages

- Secure as virtual cards have different card numbers compared to your physical card

- Easy for mobile payments – no need to carry a physical card

- Freeze and unfreeze your virtual card, or destroy it and get a new one, with no need to cut up your physical card

Disadvantages

- Can’t be used for transactions where a physical card is needed, like using an ATM

- Card or account fees may apply depending on the card you pick

- Some cards have foreign transaction fees which pushes up the costs of international spending

Are international virtual cards safe?

Virtual cards have different card numbers compared to your physical debit or credit card, which can provide additional security. In this case, if a virtual credit card number is compromised, you can easily cancel the virtual number and keep your actual card number the same.

Conclusion: is the international virtual card worth it?

Virtual credit and debit cards are useful as you won’t need to carry a physical card with you, but you can still make mobile payments, and shop online easily. Depending on the provider you pick, your virtual card can also add extra security to your credit or debit card account, as you may be able to generate and cancel virtual cards, even for one time use only. Different cards have their own features and fees – and virtual cards can often be issued as both debit or credit cards depending on your preferences.

Use this guide to pick the right virtual card for you, and remember to check out options like the Wise virtual card if you like to travel or shop online with international retailers. Wise accounts let you hold 40+ currencies, with mid-market exchange rate currency conversions and low fees, which can mean your foreign currency purchases cost less, compared to using a card with a high foreign transaction fee.

FAQs – Best virtual card

Does PayPal have a virtual card?

PayPal does not have a virtual card option available in New Zealand at the time of writing.

What other banks offer virtual debit cards?

If you’re looking for a virtual card to link to your regular current account it’s worth checking if your bank offers this service. Major New Zealand banks have credit and debit cards you can link to a digital wallet, to generate a virtual card with the same details as your physical card.

What’s the difference between a virtual debit card and a virtual prepaid card?

A virtual debit card may be linked to a bank account, or an ongoing account from a specialist provider. You can then add or withdraw funds, and make payments from your account. A prepaid card on the other hand has to be topped up before you can use it, and can often come with a more limited range of services compared to a virtual debit card.