PayPal Payment Gateway Review

If you've ever bought anything online, you've surely come across PayPal before. And if you need a payment gateway for your business, you've no doubt considered using it as well. Being one of the most well known names, it's easy to to identify and trust the brand. We've written this PayPal payment gateway review so you can see if it really is the right product for you.

What this review will cover:

- What PayPal is

- How it works

- How much it costs

- Pros and cons

- Who should use it

- The Currency Shop's verdict

- FAQs

What is PayPal?

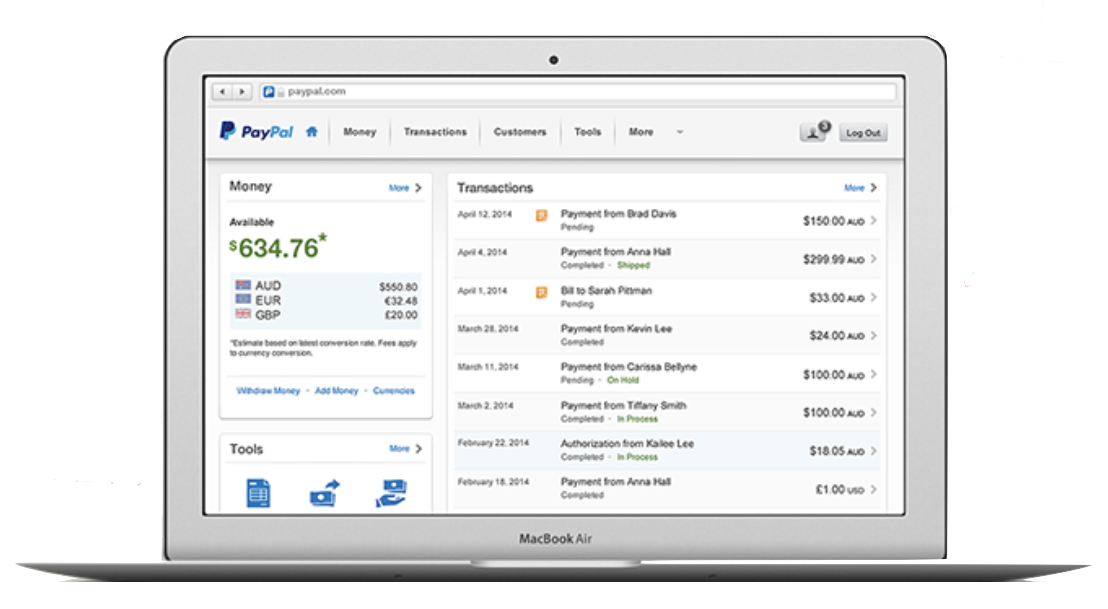

PayPal is a company that first and foremost acts as a payment gateway. Business and marketplace owners can integrate it onto their websites so that people can check out via PayPal. Customers and businesses alike can have PayPal accounts and use it to pay friends, transfer money overseas and shop online.

You can also use it to make international money transfers. Read more about that here.

How does it work?

The Basics

Once you've set up your PayPal account, this is how it will work for you and your customers:

- Customers choose what they want to buy through your website

- PayPal processes the payment, keeping both the customer and business details safe.

- PayPal then pass the payment onto you, once they have deducted their fees.

Setting up an account

There are three basics steps to getting your account set up:

- Verify your address

- Link your bank account so that you can receive payments

- Create security questions for your account.

Who should use it?

A PayPal business account can be a suitable option for any businesses that need to accept payments from customers through their website or marketplace. It will mean that customers can easily purchases your goods and services, without having to set up a PayPal account of their own.

For consumers, PayPal can act like a digital wallet where you hold different cards and can then choose which one you want to use through different websites.

What are the fees?

For New Zealand Payments

- Online payments: 2.6% + $0.30

- Website Payments Pro - Hosted Solution: 1.75% + $0.30

- Invoices: 2.6% + $0.30

- PayPal Here card reader: 1.95%

- PayPal Here (manual entry): 2.9% + $0.30

- Virtual terminal: 3.6% + $0.30

- Donations: 1.1% + $0.30

For International Payments

- Online payments: 3.6% + fixed fee

- Website Payments Pro - Hosted Solution: 3.6% + fixed fee

- Invoices: 3.6% + fixed fee

- PayPal Here card reader: 1.95%

- PayPal Here (manual entry): 2.9% + fixed fee

- Virtual terminal: 4.6% + fixed fee

- Donations: 2.1% + fixed fee

Learn more about PayPal fees

Pros and Cons

Pros

- Well known and trusted brand.

- User friendly for both consumers and businesses and works well on mobile.

- Easy to keep track of transaction and create and view invoices.

- Can send and receive money to others with PayPal accounts quickly.

Cons

- Customers have to leave your site to check out.

- Can become expensive for business and marketplaces.

- PayPal hold the right to freeze your account if they detect suspicious activity. This can be detrimental for your business.

- You need to be careful of bank receiving fees if you're transferring money from your PayPal account to your regular bank account.

Final Verdict

Is PayPal a Good Option?

PayPal can be a good solution for businesses that need to process transactions through their website.

The Currency Shop says:

- PayPal is easy to install and easy for customers to use.

- Make yourself aware of all the fees involved before signing up.

- Remember that you can't access the payments processed by PayPal immediately. They're available usually 3-4 days later.

Learn more about PayPal

Frequently Asked Questions (FAQs)

Is PayPal Secure?

PayPal is fully regulated in Australia with an Australian financial services license (AFSL) and regulation by the Australian Securities and Investment Commission (ASIC).

They are also regulated internationally if your business has overseas customers and clients.

Read more here.

Where is PayPal available?

PayPal is available in over 200 countries and supports 25 different currencies. The countries PayPal is available in is listed fully on their website.

What currencies does PayPal support?

The currencies they are support are:

AUD, BRL, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HUF, INR, ILS, JPY, MYR, MXN, NOK, NZD, PHP, PLN, RUB, SGD, SEK, THB, TWD, USD.

Which cards does PayPal accept?

Visa, MasterCard and American Express. Read more here.

How do you process refunds with PayPal?

Refunds can be issued to customers within 180 days of them making the payment. The refund will be taken from your PayPal balance, so you need to have at least the PayPal balance in your account for it to be processed. It is done through the activity tab in your merchant portal. Find out more about issuing refunds through PayPal here.