Best GBP Card in New Zealand 2026

A GBP card is a smart way to transact in British pounds, which can help you access better NZD-GBP exchange rates and lower overall costs. You can use a GBP card when you travel to the UK, for spending and withdrawals – but it’s also handy if you’re shopping online with British retailers, as you’ll be able to pay in pounds with no foreign transaction fees.

This guide to GBP cards you can get in New Zealand walks through a few of your options, including why a GBP card can help, which cards to pick, and what you can expect to pay. We’ll look at digital only services issuing GBP cards, like Wise and Revolut, and how they compare with an option from a major New Zealand bank – Westpac.

What is a GBP card?

A GBP card may also be referred to as a multi-currency card, as you’ll usually find that any GBP card also offers convenient ways to hold and spend other currencies, too. Generally you’ll get a card by ordering online, with some card options coming from specialist non-bank providers, and some direct from banks themselves. Your card will be linked to a multi currency account that you can top up in NZD, and then convert over to GBP or whichever other currencies you need, for spending and withdrawals. GBP cards pretty much always come with apps so you can view your account, add money and make conversion while you travel.

What is a GBP card good for?

A GBP card is a secure and cheap way to spend in British pounds, in person and online. Your GBP card won’t be linked to your normal NZD everyday account which makes it safe, and convenient for budgeting for travel. Plus, you’ll usually be able to add your money in New Zealand dollars and then switch over to British pounds to lock the exchange rate and set your travel budget.

Generally GBP cards are aimed at people who travel a lot, and come with benefits selected for people spending internationally – including good exchange rates and low or no cost international ATM withdrawals. Overall, this can mean using a GBP card in the UK is far cheaper than using your normal bank card.

Pros and cons of GBP card

| GBP card pros | GBP card cons |

|---|---|

| ✅ Exchange rates are often better than those you’ll get from your bank

✅ No foreign transaction fee when you spend a currency you hold ✅ Secure for spending and withdrawals ✅ No need to carry lots of cash when you travel ✅ Keep your GBP card after your trip, and use it again next time you travel |

❌ Fees apply to some transactions

❌ Monthly charges may be levied for some account types ❌ You’ll usually need to wait a week or two for your card to arrive by mail |

3 best GBP cards in New Zealand

New Zealand has several different options for GBP cards you can use for secure and convenient spending in pounds. We’ve highlighted a couple of top picks from digital specialist services – Wise and Revolut – as well as the Westpac multi-currency card offering. Here’s what you need to know.

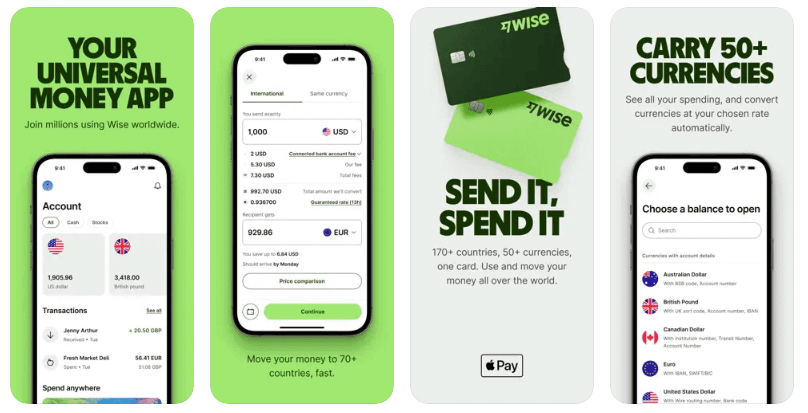

Wise

Open a Wise account online or in the Wise app, to hold and exchange 40+ currencies including NZD and GBP. Once your account is set up you can order your Wise card for a one time fee of 14 NZD, for spending and withdrawals in 150+ countries globally. There’s no monthly card fee to worry about, and no minimum balance requirement. You just add money in the currency of your choice and you’re ready to start spending.

Read here a full Wise card review

All currency conversion uses the mid-market rate and low fees from 0.43%. If you want to exchange your money in advance you can, but you can also choose to leave your money in NZD and let the card’s autoconvert tool do the conversion for you at the point of payment, with the lowest available fee and no foreign transaction charge.

| Wise GBP card pros | Wise GBP card cons |

|---|---|

| ✅ Currency conversion uses the mid-market rate, with fees from 0.43%

✅ No need to convert funds in advance as the card can automatically switch to GBP at the point of payment with no extra charge ✅ No monthly fees or minimum balance |

❌ 14 NZD one time fee to get your card in the first place

❌ Some transaction fees apply, including ATM fees once you’ve exhausted your fee free allowance |

Revolut

Revolut, newly launched in New Zealand, is a financial super app that already has 30 million customers globally. Revolut has 3 account tiers, all of which come with physical and virtual cards you can use to spend in GBP as well as a staggering selection of around 200 currencies. The exact features you get from your account will depend on the tier you select, but can include no-fee currency exchange and convenient ATM withdrawals at home and abroad, plus extra travel perks and benefits.

You’ll need to pay a monthly fee for some higher tier account packages, and transaction fees apply once you exhaust your particular account type’s no-fee transaction limits.

| Revolut GBP card pros | Revolut GBP card cons |

|---|---|

| ✅ Choose from 3 different account types, depending on your spending needs

✅ Use your card in 150+ countries, to spend in multiple currencies ✅ Secure account you can manage from your phone |

❌ Monthly account fees apply for some account types

❌ Some transaction fees apply, depending on the account you pick |

Westpac Global Currency Card

You can order a Westpac Global Currency Card online, and have it delivered to your home in 5 to 10 business days. There’s no order or purchase cost, and your card will support 9 major global currencies including GBP. Add money to your card in NZD, with a minimum load of just 10 NZD, and convert to GBP online for convenient spending and withdrawals.

You can use your card to make withdrawals and spend securely anywhere that you see the Mastercard logo. If you’re spending in GBP it’s important to remember that you’ll need to convert your funds from NZD to British pounds before you complete your first transaction – otherwise you’ll find you pay a 2.95% conversion fee.

| GBP card pros | GBP card cons |

|---|---|

| ✅ 9 currencies are supported

✅ No purchase fee, no monthly fee ✅ No fee to top up by bank transfer |

❌ 2.95% fee if you spend in a currency you don’t hold in your account

❌ 1.5% fee to load funds with a debit card ❌ Exchange rate markups apply when you convert from NZD to the currency you need for spending |

Where can I use a GBP card?

Use your GBP card any time you need to spend in British pounds. That may be when you travel to the UK, or when you shop online. Using a GBP card means you can convert your dollars to pounds in advance and then you’ll not need to pay any foreign transaction fee when you spend or make currency withdrawals. Plus, the exchange rate you get is often better than the one you get from your bank.

GBP card in New Zealand

All of the cards we’ve highlighted above can also be used in New Zealand. However, it’s important to bear in mind that you may end up paying fees for currency conversion if you’ve got a balance in GBP and use it to spend here at home. The card may charge you a percentage fee to convert your balance back to NZD, which could be as high as 2.95% in the case of the Westpac card.

What are the requirements to get a GBP card

Usually to get a GBP card you’ll need to be 18 or older and have a passport or driving licence available for verification purposes. You’ll normally need to enter the information from your passport or licence, or upload a photo of it, when you apply for your card. This is to keep accounts secure and to comply with global laws.

Finally, when you order your card you’ll need to either top up to add a balance, or pay a one time fee, so you’ll have to have a bank account or card you can use for this initial payment, too.

Costs of getting a GBP card in New Zealand

Each provider will have their own fees for getting a GBP card in New Zealand. The approaches vary quite a bit with some services like Wise having a one time card order fee but no ongoing costs, and others, like the Revolut card options we’ve detailed above, having some accounts with monthly fees. The good news is that because there’s quite a variety of card options for spending in pounds, you’ll be able to pick the one that suits you and your spending patterns easily.

GBP card fees

| Provider and card | Wise Card | Revolut Card | Westpac Global Currency Card |

|---|---|---|---|

| Get a card | 14 NZD | No fee | No fee |

| Add money | Free to add money with local bank details in 9 currencies | No fee options are available |

|

| Account maintenance fee | None |

|

None |

| Spend in GBP |

|

|

|

| ATM withdrawal |

|

Costs and no fee allowances may vary based on account type |

|

*Information correct at time of writing – 17th November 2023

GBP card exchange rate?

The exchange rate you get from NZD to GBP will depend on the provider and card you pick. Wise uses the mid-market exchange rate with no markup, and splits out all the costs of conversion transparently so you know exactly what you’re paying. Revolut accounts all come with some no fee currency conversion which uses the mid-market rate. However, the amount of no-fee conversion you get will depend on the account plan you pick, and fair usage fees will kick in once you exhaust your plan limits. Westpac’s Global Currency Card exchange rates are set by the bank, and are likely to include a markup.

How to get a GBP card in New Zealand

All of the GBP cards we’ve highlighted above have to be ordered online or through an app. You’ll need to open an account with the provider or bank, which you can do online, and provide some ID for verification. That’s usually as simple as snapping a picture of your passport or driving licence with your phone and uploading it.

Once you’ve completed your personal details, and set a secure password, you’ll have to pay any required card order or top up fee, and you can then sit back and wait for your card to arrive in the post.

Conclusion – Best GBP Card in New Zealand

Using a GBP card when you’re in the UK or when you spend online with British retailers can help you save money and access better exchange rates compared to using your normal bank card. GBP cards are also secure and easy to use when you’re away, and can make budgeting for your trip easier. Just add your money in dollars and switch it over to pounds in advance, to lock in the exchange rate and see your travel budget in the local currency immediately.

Use this guide to check out the GBP cards on offer in New Zealand from providers like Wise and Revolut, as well as options from major banks, to see which suits your needs.

FAQ – Best GBP Card in New Zealand

What are the benefits of using a GBP card?

Using a GBP card when spending in pounds can mean you pay less overall as you may get a good exchange rate with no foreign transaction fee to pay. You’ll also be able to see your travel budget instantly and your card is secure as it’s not linked to your normal everyday bank account.

Are GBP cards available in New Zealand?

Yes. You can get a GBP card in New Zealand from a bank like Westpac, or from a specialist non-bank alternative like Wise or Revolut. Non-bank alternative services often have low fees and transparent exchange rates, as well as perks and features aimed at frequent travellers.

How much does a GBP card cost?

GBP cards may have an order or delivery fee, or may have monthly charges. It all depends on the specific card you select. The good news is that there are several to choose from, including accounts and cards from non-bank alternative like Wise or Revolut, and from banks like Westpac.