Best bank accounts for a non-resident in New Zealand – 2026

If you’re moving to New Zealand soon, getting a bank account set up is going to be essential for daily life once you arrive. Or maybe you want an NZD account even if you don’t plan to relocate – as a frequent visitor, or if you need to send NZD payments frequently for example.

The options for bank accounts for a non-resident in New Zealand are going to depend a bit on your plans, and whether you’re relocating to the country soon. This guide walks through your choices with New Zealand banks – and some alternatives which may be more flexible, like Wise and Revolut. More on that, later.

Quick summary: non-resident bank account in New Zealand

- Most New Zealand banks only offer non-resident accounts to customers who plan to relocate to New Zealand

- If you’re moving to New Zealand you might be able to open an account up to 180 days before your relocation – but you won’t get full feature access until you arrive

- If you’re not moving to New Zealand, providers like Wise and Revolut can be a good alternative as they allow you to hold and manage NZD from many other countries

- Bank accounts in New Zealand have their own features and fees, so you’ll need to research your options carefully if you decide to open a migrant bank account as a future resident

- New Zealand bank accounts usually only hold NZD – if you want a multi-currency account to manage your home currency alongside New Zealand dollars you might prefer an alternative like Wise or Revolut

| FAQs | Answers |

|---|---|

| Can I open a bank account without address proof in New Zealand? | New Zealand banks usually only let you open an account if you plan on moving there. Once you have a proof of address you must show it in a branch to get full access to your account. |

| Can I open a bank account online as a non-resident? | You can start the process of opening an account online if you’re relocating to New Zealand – or choose an alternative like Wise or Revolut for more flexibility. |

Can I open an account as a non-resident?

While you will find a New Zealand bank account for non residents, eligibility is usually reserved for non residents who are planning a move to New Zealand and already have a visa in place.

In this guide we’ll look at some picks for the best bank in New Zealand for migrants – but it’s important to be aware that you won’t normally get full account access and features until you’ve physically moved and provided a local proof of address. If you’re thinking more of a New Zealand bank account for expats who aren’t moving over, an alternative like Wise or Revolut might be a better fit.

Although opening a bank account in New Zealand can be a hassle, getting a NZD account from an alternative provider can be arranged from many countries and regions globally, often with low or no fees to pay to maintain your account and get a linked debit card. We’ll explore that more later.

How to open a bank account as a non-resident in New Zealand

As we’ve seen, New Zealand bank accounts for non-residents are usually aimed at people moving to the country in the near future. To give a flavour of how the process works if you’re opening a non-resident account, we’ll work through the route to opening a Westpac NZ migrant banking account –

- Check you meet the eligibility criteria: You’ll need to be moving to New Zealand in the next 180 days and will need a New Zealand visa already lined up.

- Assemble the required paperwork, including having documents certified : To apply you’ll need your certified Passport, certified Visa, and certified proof of address – check carefully who is eligible to certify documents to avoid wasting time.

- Download, print and complete the required application: The application form is available on the Westpac NZ website and can be downloaded for completion.

- Email all the documents needed to Westpac for checking: Email everything over to Westpac’s migrant banking team. If they need anything more they’ll reach out – and once your account is approved you can pay money into it.

- Complete the application in a branch when you arrive in New Zealand: Once you arrive you need to go to a branch to activate your account to get full access to the features. You will need to take your original Passport, and Visa – contact Westpac Migrant Banking to arrange an appointment in advance.

Non resident account requirements

New Zealand banks usually only offer accounts to residents – or to non-residents who are in the process of moving to New Zealand. Usually you must be moving to New Zealand soon – while banks vary, this may mean within the next 180 days. You must also have a Visa for New Zealand ready for your move.

You can start to open your account online with several major banks, but you can not access all features until you actually move and activate your account in a New Zealand branch of the bank you’ve selected.

If you want a more flexible option you can open from many countries and regions around the world, consider a provider like Wise or Revolut. You can open your account to hold, send, spend and receive NZD alongside many other major currencies, with linked debit cards and plenty of other features which are helpful when you live an international lifestyle.

What documents do you need to open an account as a non-resident?

| Required documents for bank non-resident account |

|---|

| Example for Westpac New Zealand:

All documents must be certified by a trusted referee – this can be an accountant or lawyer for example, or someone from the Consulate of New Zealand. There’s a full list of who can certify documents on the Westpac NZ website. |

What is proof of residency to open an account in New Zealand?

You’ll usually need to prove your address outside of New Zealand and then go to a branch once you arrive, to prove your New Zealand address once you have it. Different banks allow different documents for proof of residency. However, some common examples include:

- A bank statement in your name

- A recent utility bill in your name

- An official government document which shows your address

Account alternatives for non-residents

As we’ve seen, your account alternatives for non-residents depend on whether or not you’re moving to New Zealand soon. We’ve looked at one major bank – Westpac – which can help you if you’re moving to the country, and also a couple of alternatives.

Wise and Revolut both offer NZD account options which you can get from many different countries and regions – no matter whether or not you’re moving to New Zealand in future. Let’s explore.

| Service or feature | Westpac | Wise | Revolut |

|---|---|---|---|

| Open from outside New Zealand | Yes | Yes | Yes |

| Open if you’re not relocating to New Zealand | No | Yes | Yes |

| Supported currencies | NZD | 40+ | 25+ |

| Account maintenance fees | Variable fees depending on the account you select | No maintenance fees | Variable fees depending on the account you select |

| International payments | 5 NZD outgoing payment fee, 15 NZD incoming payment fee | Low transfer fee for outgoing payment, receive with local account details for free

Small fees apply for receiving SWIFT transfers |

Variable fees depending on the transfer type, the account you hold, and your residency |

*Details correct at time of research – 3rd June 2025

Westpac account

💡Great for: People relocating to New Zealand in the next 180 days, looking to start to transfer funds to New Zealand in advance

Westpac is a major bank in New Zealand and regionally. To open an account with Westpac NZ you’ll need to be planning on moving to New Zealand in the next 6 months, and you’ll need a New Zealand visa. On arrival you also have to provide a full suite of documents to activate your account. Prior to moving you can transfer money to NZD, and start to build a credit history in New Zealand, but you won’t get full feature access until you’re a resident.

Eligibility: Customers must be planning on moving to New Zealand in the next 180 days after application, with a certified visa

| Westpac account pros | Westpac account cons |

|---|---|

| ✅ Major bank with a full suite of services

✅ New migrants often get promotional discounts and extra perks ✅ Start the application online ✅ Send money to NZD before you move, so you have savings ready for your relocation |

❌ Only available to people relocating to New Zealand

❌Accounts are only fully opened on arrival |

How to open a Westpac account as a non-resident

- Check you meet the eligibility criteria

- Assemble the required paperwork, including having documents certified

- Download, print and complete the required application

- Email all the documents needed to Westpac for checking

- Complete the application in a branch when you arrive in New Zealand

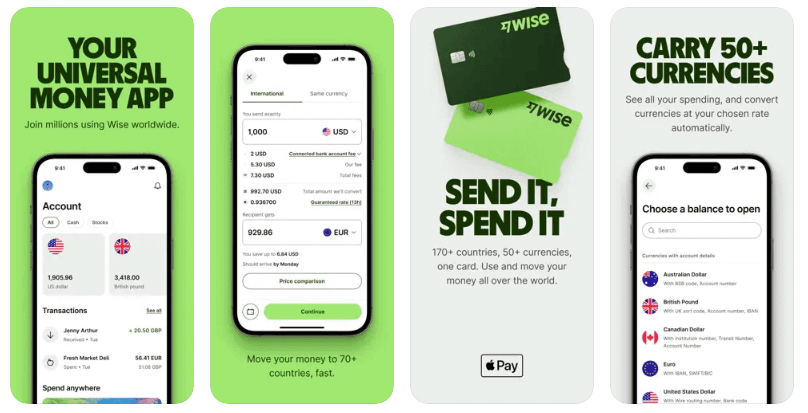

Wise account

💡Great for: Hold, send, receive, spend and exchange NZD alongside many other currencies, from many countries around the world

Open your Wise account from your phone or laptop, with everything from application and verification to onboarding and account management done online or in-app. You can apply from many countries globally, and just upload your normal proof of ID and address to get verified, with no need for a New Zealand residence visa. Order a debit card for spending, and hold and exchange 40+ currencies, with the mid-market rate and low fees to convert or send payments around the world.

Eligibility: You’ll need a government issued ID from a country Wise operates in, and in some cases a proof of address or tax number to apply

| Wise account pros | Wise account cons |

|---|---|

| ✅ Hold and exchange 40+ currencies in one account

✅ Receive payments in NZD, and send money to New Zealand conveniently ✅ Mid-market exchange rates ✅ Low, transparent fees |

❌ Variable currency conversion fees apply

❌ You may pay a one time fee to get a debit card |

How to open a Wise account as a non-resident

- Download the Wise app or open the Wise desktop site

- Click Sign up and create an account with your email, Facebook, Google or Apple ID

- Follow the prompts to enter the details needed

- Upload a snap of your ID and address documents

- Once your account has been verified you’re good to go

Revolut account

💡Great for: Range of account types and plans, including some with no ongoing fees in many countries – accounts hold NZD and come with linked debit cards

Revolut has multi-currency accounts and cards which have variable features depending on the country you live in and the plan you pick. You usually get some weekday currency exchange with no extra fees, and linked debit cards. In many countries you can pick a standard plan with no monthly fees, or upgrade to pay a monthly fee and get more perks and higher no fee transaction levels.

Eligibility: Available to customers with addresses in countries and regions including New Zealand, the UK, the US, the EEA, Australia, Singapore, Switzerland, Japan, and New Zealand.

| Revolut account pros | Revolut account cons |

|---|---|

| ✅ Revolut supports around 25 currencies

✅ All accounts have linked debit cards ✅ Choose from different account tiers and plans ✅ Most accounts have some no fee transaction options included |

❌ Monthly fees apply for the most feature packed accounts

❌ Fair usage and out of hours currency exchange fees may apply |

How to open a Revolut account as a non-resident

- Download the Revolut app

- Enter your phone number and set a PIN – you’ll get a verification message from Revolut

- Use the verification code to access the app and enter the details needed to create your account

- Upload the required documents for verification

- You can deposit funds and use your account once verified

Bank account for foreigners in New Zealand

New Zealand banks do allow non-residents to open an account, but usually only if you are planning on moving to New Zealand in the next 6 months or so, and already have a valid visa. Banks like Westpac allow you to start the application in advance, but you won’t be able to get your account fully activated until you arrive in New Zealand and visit a branch for verification.

If you’re looking for a true non-resident account for New Zealand, an alternative provider like Wise or Revolut could help. Open an account fully online or in-app, and hold NZD and other major currencies for convenience.

Non resident bank account FAQs

Can I open a New Zealand bank account online as a foreigner?

Banks like Westpac allow you to start your account application online if you’re moving to the country, but you won’t be able to get your account fully activated until you arrive in New Zealand and visit a branch for verification.

Can a tourist open a bank account in New Zealand?

Generally New Zealand banks will not offer accounts to tourists, or even working holiday visa holders. Instead, an alternative provider like Wise or Revolut could help. Get an account from more or less anywhere in the world to transact in NZD conveniently.

Can I open a New Zealand bank account with a passport?

No. You need several documents to open a New Zealand bank account, including proof of address and your valid visa.